It’s boom time for data centres. In SA, big tech’s heaviest hitters are racing to connect the country and the continent to the global cloud. Microsoft, Google Cloud, Amazon Web Services, Oracle, Africa Data Centres, Dimension Data… You name them, they’re opening a data centre – probably in your city.

Yet it’s not just SA. According to a new DLA Piper report, the volume of investment in global data centres has more than doubled year-on-year, rising to $59.5 billion. The total number of transactions also increased, growing by 64% to 117.

‘Our report reveals record-breaking investment in data centres,’ according to Anthony Day, DLA Piper’s global co-chair of technology and sourcing. ‘There is no end to this demand, with investment to date in 2022 more than double for the same period in 2021.’

Those generic data centres are also bringing a rise in colocation facilities. Colo centres are ‘carrier hotels’ that allow retail clients to rent equipment, space and bandwidth within a data centre, letting them enjoy the benefits of robust, state-of-the-art IT infrastructure. Importantly, in the SA context – where tech systems need to service a range of business needs in both SMEs and large corporates – colocation solutions are scalable, depending on the client’s demand.

‘The biggest drawcard of colo facilities worldwide is the specialised services they offer,’ adds Andrew Cruise, MD of cloud provider Routed. ‘These providers have expert facilities managers who have skills in security, power, and cooling – which few enterprises will have in their own data centres. This division of labour lowers risk and addresses many of the concerns enterprises have in running their own data centres.’

Cruise points to connectivity as another driver of growth in colo. ‘The better colo facilities have free peering points as well as private exchanges that serve as on-ramps into local and hyperscale cloud providers,’ he says. ‘The prevalence of good-value, fast and reliable connectivity into the data centre now makes colocation an acceptable option.’

He adds that in SA there’s a third – and very important – reason for the shift to colocation. These facilities offer reliable power during rolling power cuts and load shedding. Peter Hodgkinson, director at professional services firm WSP in Africa, Building Services, agrees.

‘Energy security is a critical consideration,’ he says. ‘Given the purpose of a data centre, being able to offer nearest to 100% uptime is not only a key market differentiator but, increasingly, a non-negotiable in this digital age. However, most markets across Africa experience some level of unstable power supply at best.’

The JSE’s own colocation facility is a case in point. Langa Manqele, Head of Equities and Equity Derivatives at JSE Capital Markets, says that about 65% of the JSE’s trading activity now comes via colocation. It’s a remarkable percentage, given the exchange’s colo facilities opened only in 2014. ‘Data centres in Africa typically service all kinds of industries,’ says Manqele. ‘An exchange like the JSE has a high demand in terms of near-zero latency, and you can’t risk using a generic data centre for that. You have to be where the trading engine is.’

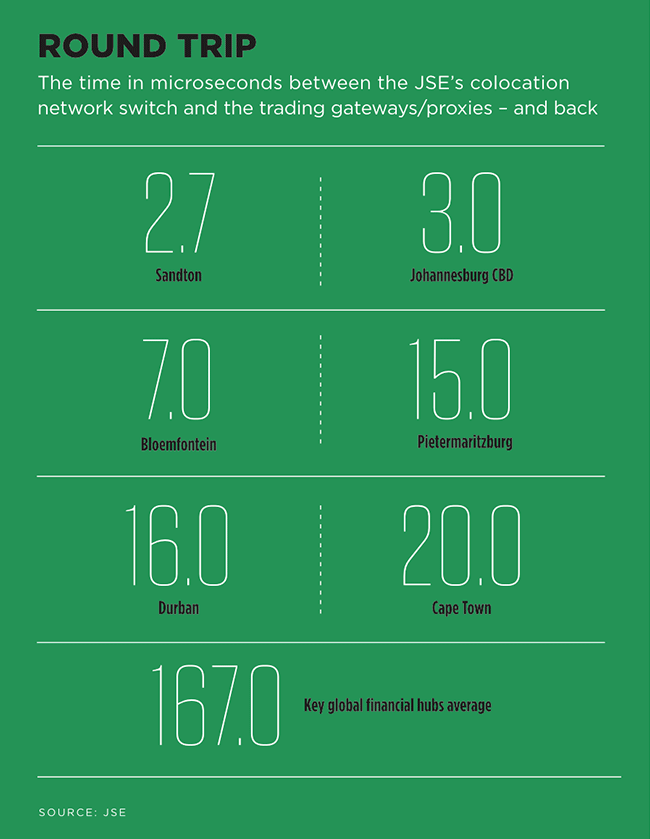

The latency between the JSE’s on-site colocation facility and the surrounding Sandton area – where most of its clients are based – is just 2.7 microseconds, compared to the 2 400 one might typically expect from a generic data centre.

However, it’s not just about speed. As Cruise highlights, there’s a reliability aspect to this as well. ‘Because of the need for us to ensure the always-on availability of the service, we had to set up our own exchange-owned data centre,’ says Manqele. ‘We just couldn’t have our trades running through a third-party data centre. This is our centre, and we manage the power supply, cooling systems, backups and other resources.’

As if to underline his point, Manqele’s interview took place during load shedding. ‘The coffee shop down the road is closed, but our colo servers are still humming along, with zero down time.’

‘We are in the age of the internet/digital economy,’ says Michele McCann, head of platforms and interconnection at Teraco Data Environments. ‘The price for participation is the digital infrastructure needed to be online and available 24/7. Data centre infrastructure and connectivity underpin this world. Colocation data centres are now at the core of these conversations.’ McCann adds that with the advent of the public cloud, the rapid digitalisation of organisations and increased internet access, the benefits of outsourcing data centre infrastructure are clear.

‘The ability to scale rapidly, access complete ecosystems of services, a wide choice of connectivity options, improved network security and speed, direct access to cloud onramps, and a shift from a capex to an opex model have made colocation a very attractive and low-risk solution to fulfil data centre needs,’ she says.

There’s clearly an appetite for specialised colocation solutions. In September 2022, a group of 15 major SA financial institutions migrated their sensitive business data and hosted systems to Teraco’s data centre infrastructure in an operation that saw 100 TB of sensitive data being migrated seamlessly and securely. All 15 institutions are customers of outsourced banking and payments service provider Direct Transact and, collectively, they make up 70% of SA banks that participate directly in the national payment system.

‘The new Direct Transact hybrid infrastructure at the state-of-the-art Teraco facility allows for the best of both cloud and hosted servers to ensure minimal latency between hosts, full redundancy, maximum scalability and security,’ according to Dirk Labuschagne, executive head of business support services at Direct Transact.

‘The move to Teraco was a delicate but important operation. Even a few seconds of downtime could have been very disruptive for the South African banking and payments ecosystem, but we pulled it off without a single hitch, in a move that is ultimately to the benefit of the entire financial ecosystem of the country.’

Yet while banks and investors are leading the way in terms of colocation and data centre migration, other businesses – of any size – can also enjoy the same benefits of reduced risk, flexible connectivity and reliability. With fibre-optic cable networks now deployed in all SA metros, colo and cloud (or a combination of the two) are viable and sustainable solutions. However, says Cruise, ‘of course, you pay for it. This means it’s not for everyone, but for those who do go the colo route, the pricing is at least very predictable’.

In all the excitement of cloud migration, Cruise says there are many examples in developed countries of unexpected overspending running wild following the move of traditional IT operations-based infrastructure into hyperscale cloud. ‘This has led to repatriation onto owned infrastructure or private cloud offered by local cloud operators with predictable price models. But in South Africa, we have the benefit of learning from such overseas mistakes.’

The JSE’s colocation facility reflects that growth in colocation demand – and in the broader data-centre environment. ‘The space that we currently occupy at the JSE accommodates 71 racks,’ says Manqele. ‘We’ve run out of room to accommodate further capacity, so we’re knocking down the adjacent space in our building and expanding it to add about 43 additional racks. With the capacity we have in the pipeline, we are headed to over 100 racks.’

Expect Manqele and his team to knock down a few more walls in the months and years to come. The cost optimisation, risk mitigation and connectivity provided by data centres – and, specifically, by colocation – make the technology a must-have for certain industries … especially those in which every microsecond counts.