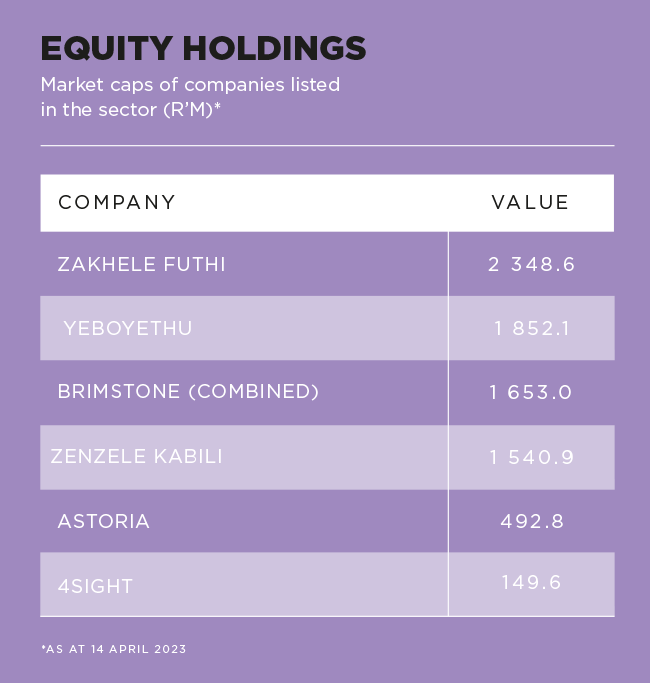

Qualifying black investors who want to participate in listed empowerment schemes can access a number of these on the JSE. Four large schemes, offering exposure to MTN, Vodacom, Sasol and AB InBev subsidiary SAB, are available.

Three of these are listed in a segment of the market that is often overlooked, alongside a black-owned investment company and two smaller entities. These are not strictly investment holding companies per se but could be considered as such, generally speaking.

They are BEE schemes that have rolled over in transactions after their original schemes reached maturity. These are the three largest constituents of the open-end and miscellaneous investment vehicles sector of the JSE. They are all listed in the bourse’s empowerment segment and trade in these shares is restricted to black South Africans or groups, as defined in the B-BBEE Act.

These are MTN Zakhele Futhi, the roll-over of its Zakhele scheme; Vodacom’s YeboYethu (which was restructured in 2018); and SAB’s Zenzele Kabili scheme, which replaced the Zenzele one on its maturation in 2021. (Sasol’s Inzalo BEE shares are listed in the chemicals sector, and are also part of that segment.)

MTN’s Zakhele Futhi holds 77 million shares in MTN Group, equal to an approximate 4% stake. The group says ‘it was established as a ring-fenced, special purpose vehicle through which qualifying members of the black public could indirectly invest and hold shares in MTN Group’.

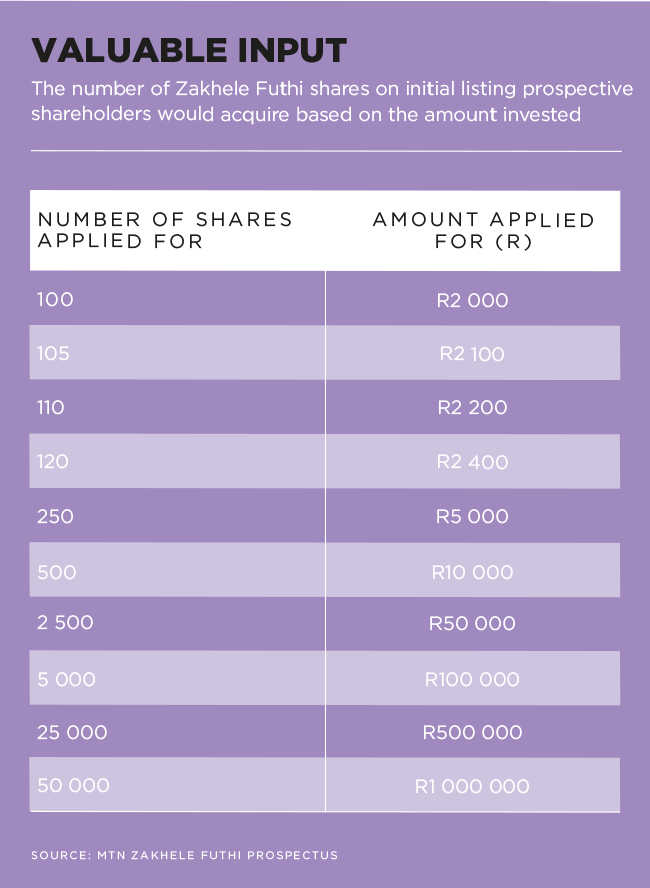

The deal was launched in 2016 to replace the previous MTN Zakhele scheme, which unwound in that November (and held shares at the MTN South Africa level). It is structured as an eight-year deal, with a lock-up in the first three. Following the expiry of this, the shares were listed on the JSE in November 2019.

Craig Gradidge, co-founder of Gradidge-Mahura Investments, says both the Zakhele Futhi and Zakhele deals are similar in capital structure. He notes that the original empowerment deal delivered a return of more than 150% since inception in 2010. With Zakhele Futhi, investors were essentially being ‘given a second bite at the proverbial cherry’.

In 2020 and 2021, the scheme received cash injections totalling R90 million to meet its financial commitments. This was due to MTN Group withholding dividends owing to the impact of the COVID-19 pandemic on its operations. Like other BEE schemes, Zakhele Futhi relies on dividends from its investee company (MTN) to fund operations (primarily interest and loan repayments). At the end of June 2022, Zakhele Futhi’s shares in MTN were worth R6.7 billion. It had approximately R2 billion of liabilities in the scheme (preference shares and equity option funding). It has been using excess cash from dividend flow to steadily repurchase these preference shares (this also means fewer dividends need to be paid to these shareholders).

It’s worth noting that the MTN share price has been incredibly volatile since the end of 2016, when Zakhele Futhi was implemented. At that point, shares were trading at around R120. These dropped to closer to the R40 level when COVID-19 lockdowns hit, rebounded to just under R200 a year ago, and are now at about the R130 level. Zakhele Futhi shares listed at R20, peaked at R37 and are now back at around R19.

The investment case remains inextricably linked to the outlook for MTN Group as a whole. Gradidge says major risks remain ‘increased competition in key markets; political risk in Nigeria in particular; the economic outlook for Nigeria, given low oil prices; and reducing voice revenues’. On the upside, management has been diligently executing a plan to sell non-core operations and deleverage its balance sheet (reduce debt). There is also the potential valuation uplift by separating its Mobile Money (fintech) business and the introduction of minority investors in it.

Similarly, YeboYethu originally held a stake in Vodacom South Africa before a 2018 deal where this was restructured into a holding in the listed Vodacom Group. Gradidge says YeboYethu ‘was initially offered to qualifying black South Africans in 2008 at R25 a share, as a 10-year deal’. It ‘delivered solid results with a R73 special dividend in 2018, in addition to the dividends it delivered over the 10 years’.

Originally, the restructured YeboYethu held a 6.23% stake in Vodacom, but subsequent transactions to acquire parent Vodafone’s holdings in Safaricom and Vodafone Egypt have seen this reduce to 5.5%. The holding, in an enlarged group, is worth R14.3 billion.

YeboYethu says its ‘objectives remain to maximise value for its shareholders and facilitate ongoing investment in a respected listed black investment vehicle with a good history and strategic partners (Royal Bafokeng Holdings and MIC Investment Company)’. YeboYethu shares peaked at more than R120 a share at the time of the special dividend in 2018, before trading down at the R16 level when the transaction was restructured. Today, these shares trade at around R35.

Like the two telecoms structures, SAB’s Zenzele Kabili scheme replaced the brewer’s original Zenzele one when it unwound in April 2020. It ultimately delivered approximately R14 billion in value for beneficiaries – including 29 000 retailer shareholders, 13 000 current and former SAB employees and the SAB Foundation – across a decade, and it was the largest BEE transaction concluded in the fast-moving consumer goods sector in the country.

Shareholders could elect to receive their final distribution in either JSE-listed AB InBev shares or in cash proceeds from the sales of these. Towards the maturation of the original scheme, SAB says it ‘received consistent feedback from SAB Zenzele shareholders that they want the opportunity to re-invest part of the value from the unwind of SAB Zenzele into a new empowerment scheme that will hold shares directly in AB InBev’.

The Zenzele Kabili structure was implemented to allow shareholders this opportunity. The transaction, valued at R5.4 billion, was funded through ‘a combination of a R678 million equity contribution from existing SAB Zenzele shareholders; a R600 million equity contribution from a new broad-based employee share ownership programme that was funded by SAB; a R344 million reinvestment by the SAB Foundation; R811 million of AB InBev discounted shares from SAB; and R2.97 billion of 10-year preference share vendor funding from SAB’.

It, too, is dependent on dividend flow from AB InBev, but this has been modest compared to Vodacom and even MTN. Its holding in the world’s largest brewer is worth around R4.5 billion and the preference share debt has been reduced to R2.6 billion. Shares are thinly traded and the price has been hovering at around R40 in early 2023.

Sasol’s SOLBE1 trades on a discount of roughly 30%, which is its long-term average discount rate. Given that Sasol has resumed dividend payments, and SOLBE1 shareholders get exactly the same dividend, it trades on an historical yield of around 13% based on the most recent dividends paid by Sasol. This is an attractive yield and makes for a strong case for investors to include it in a long-term portfolio.

Gradidge makes the important point with shares that trade in the JSE’s empowerment segment – like Zakhele Futhi, YeboYethu and Zenzele Kabili – that when considering valuations ‘investors would need to factor in a discount to compensate for the higher risk profile, high debt, single-company exposure and restricted trading between qualifying black investors’.

He argues that ‘a 30% to 40% discount should apply’ to the shares’ underlying net asset values (the value of their stakes in the underlying companies). The discount could be slightly higher for the two schemes listed on an over-the-counter platform – Phuthuma Nathi (MultiChoice South Africa) as well as Ukhamba 2 (Motus) – given the relatively low liquidity of that market.

Beyond these three empowerment schemes, black-owned investment group Brimstone is also listed in this sector. The combined market value of its ordinary and non-voting shares is around R1.5 billion. Its two major assets are subsidiary Sea Harvest (it owns 53.4% of the JSE-listed fishing group) and a 25.1% stake in Oceana. Together, the two account for nearly three-quarters of its gross asset value. These are substantial fishing businesses. Following its listing on the JSE in 1998, Brimstone began acquiring shares in Sea Harvest. By 2016, it owned 85% of the business and it listed it on the market the following year. Following this listing, Sea Harvest bought food producer Ladismith Cheese to diversify its operations. Oceana owns the Lucky Star brand.

Brimstone has two other subsidiaries, Obsidian Health and House of Monatic, which owns the Carducci and C2 brands. It also owns a number of smaller stakes in property and financial services businesses, including 1.9% of JSE-listed Equites. It is a participant in four restricted BEE structures, MTN Zakhele Futhi (1.5%), MultiChoice’s Phuthuma Nathi (2.8%), Stadio Holdings (5.1%) and Milpark Education (12.8%).

Astoria, valued at R490 million, is a Mauritius-domiciled investment company, that was originally an investor in global equities and private-equity businesses. In 2018, a company linked to RECM began building a stake in the business as it saw an opportunity given the substantial discount it was trading at to its underlying value. It eventually took control of Astoria and disposed of these legacy assets. Over time, it has split its portfolio of businesses that were listed in the RECM and Calibre (RAC) investment holding company between it and Astoria. The former now primarily holds a majority stake in the Goldrush gaming/slots group.

Astoria houses the remainder of the assets once held within RAC structure. These include stakes in a specialist retailer, the owner of Outdoor Warehouse; diamond miner Trans Hex; Leatt Corporation (a maker of PPE for motor sports and leisure activities); small private tertiary education group Isa Carstens; and the Vehicle Care Group, which provides services to the used-vehicle trade. It also owns 16% of RAC (which was obtained when the asset reorganisation was implemented).

4Sight, also domiciled in Mauritius, is a niche diversified technology group. It is valued by the market at around R150 million.

The nature of all the companies listed in the sector, being that they own shares in underlying assets, means that their value is indistinguishably linked to the values of the underlying asset or assets. In the case of the BEE structures, these are large multinational companies, and there is an expected inherent discount to the value of the stake.

Discounts are prevalent, too, in the other three companies, although the value of these assets – and therefore the performance of these shares – is more directly linked to SA’s economic growth than the three larger businesses. With reliable electricity supply remaining a constraint in the near term, and with the necessary structural reforms being implemented slowly, there remains a risk to growth surprising on the downside. Already, the country’s largest banks expect the economy to grow by around just 1% in 2023, but the underlying assets in these businesses are generally expected to show significantly quicker top-line and profit than that.