The country’s biggest landlords, which together own tens of millions of square metres of shopping malls, office buildings, warehouses, hotels, hospitals and more, are listed on the JSE, in the diversified real-estate investment trust (REIT) sector. They own many iconic properties across SA, including the V&A Waterfront, Alice Lane precinct, Black River Park, Mall of Africa and the Discovery head office.

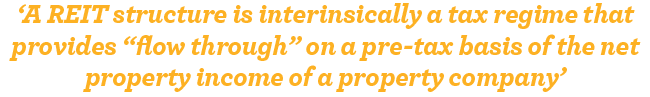

In fact, they typically own most of the properties in well-known nodes such as Sandton, Rosebank, the Cape Town CBD, Umhlanga Ridge, as well as lesser-known industrial ones across mainly Gauteng, the Western Cape and KwaZulu-Natal. The listed diversified REITs have a combined market value, as at early July, of around R140 billion.

The REIT structure was only introduced in SA in 2013. Prior to this, ‘investors in listed property companies had the choice of investing in listed property through two main structures, namely property unit trusts [PUTs] or property loan stock [PLS] companies’, according to independent global real-estate analyst Garreth Elston.

‘Neither of these structures could be considered best-in-class for property investors. PLS companies were introduced in the late 1980s as an alternative to PUTs. [They] were governed by the provisions of the Companies Act 71 of 2008 and, if listed, also regulated by the JSE. PUTs were listed on the JSE, but were regulated by the Financial Services Board [the predecessor of the FSCA] and the Collective Investment Schemes Control Act.’

‘A REIT structure is intrinsically a tax regime that provides “flow through” on a pre-tax basis of the net property income of a property company,’ Elston explains.

‘For listed property companies to maintain their REIT status, they must pay a minimum of 75% of their total distributable profits as a distribution to the holders of the REIT’s listed securities. South African legislation allows REITs to pay out a qualifying dividend without incurring income tax within the company, this is though taxed in the hands of the investor as taxable income – this is the “flow through” that allows earnings to flow through to investors without attracting income tax at the company level.’

He adds that ‘another plus is that if the REIT is held within a retirement annuity, pension, provident or preservation fund, investors do not pay tax on distributions until they receive their pension payments. The reinvestment and compounding effect of these investments are of great benefit to investors. It is important to note that while REITs that sell investment properties do not attract capital gains tax [CGT] on any sale profit, investors are still liable for their CGT on the sale of their REIT shares’.

Most listed property companies have converted to a REIT structure since its introduction almost a decade ago. Elston says that, like its effect globally, the COVID pandemic had an extremely negative impact on the South African diversified REIT sector.

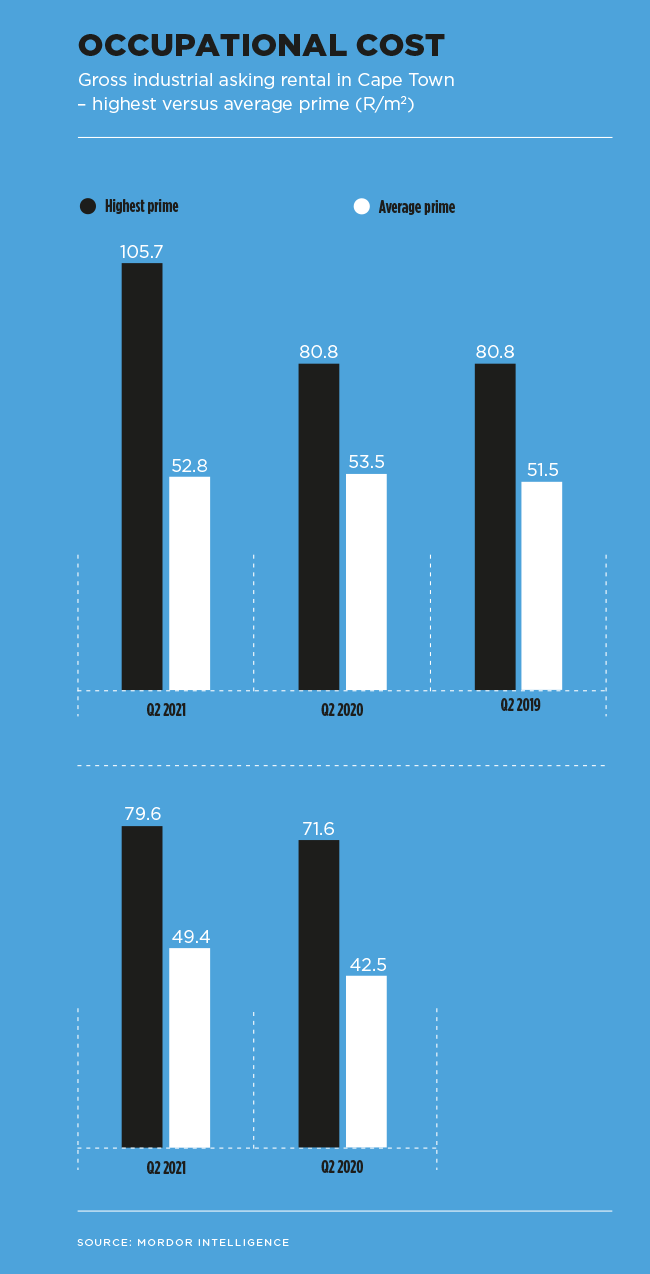

‘In particular, office holdings were tremendously hard hit by lockdowns and work-from-home policies that are still negatively impacting landlords. Lease renewals have generally seen negative reversions and this, coupled with a slow return to pre-2020 trading levels, has seen many diversified REITs having slow recoveries.’

These reversions, or renewals concluded at lower rentals than had been achieved previously, are sometimes on average in excess of -20%, particularly with office space.

‘Those companies that had convenience-type retail – an asset class that benefited from lockdowns and consumer preferences – were able to offset the impact somewhat, but larger-format malls continue to trade at levels below 2019,’ he says. ‘Despite a good bounce in company share prices in 2021, South Africa’s largest diversified REITs are still trading at levels well below that of the first quarter of 2020.’

The two largest listed diversified REITs in SA – Growthpoint Properties and Redefine Properties – comprise about half of the sector’s market value. Growthpoint, the largest, is valued by the market at around R44.9 billion. Its property assets total R164 billion, and it owns a 50% share of the V&A Waterfront (SA’s most valuable property asset), 161 office, 43 retail and 199 industrial properties in SA. It also owns a 62% stake in Growthpoint Properties Australia, a 61% interest in UK mall owner Capital & Regional, as well as a 29% share of Globalworth Real-Estate Investments, which owns office assets in Poland and Romania.

The V&A Waterfront, which Growthpoint co-owns with the Public Investment Corporation, was bought in 2011 for R9.7 billion when the previous owner, a consortium led by Dubai World, effectively became a forced seller due to the global financial crisis. Transnet, the original owner of the property, concluded its controversial sale to the consortium in 2006 for R7 billion.

Growthpoint puts the value of the property, which has a lettable area of more than 460 000 m2, at R17.8 billion. Around half this value comes from retail space, with the rest consisting of offices, hospitality, residential, marine and industrial, and undeveloped bulk.

It says that for almost a decade, the V&A’s growth was double that of the national economy, based on international tourism, events and business travel. The property was heavily impacted by COVID and international travel restrictions. But, in a recent update, Growthpoint says that ‘from January 2022, it experienced a rapid rebound as international tourist arrivals in Cape Town increased, reaching over 70% of pre-COVID levels by end-March 2022. The Waterfront should return to normalised performance, or better, within the next financial year’.

Redefine, with a market cap of approximately R25.6 billion, has an asset base valued at R71 billion, with more than 80% of this being based in SA. Its local portfolio spans 4.2 million m2 across 267 properties, with more than 4 000 tenants. Office and retail assets are fairly evenly split at around 40% of its total portfolio by value. In 2016, it acquired, then listed, the Pivotal Fund in a R6 billion deal. This helped boost its exposure to Sandton, as Pivotal owned the Alice Lane precinct, where Redefine is now one of the biggest landlords. Around a decade ago, it had almost no exposure to the node. Redefine also owns Polish landlord EPP, which had been separately listed on the JSE before its deal to acquire it earlier this year. In addition, it owns a number of logistics assets in Poland.

Capital and Counties Properties (Capco), the third-largest diversified REIT by market cap (R25.3 billion), actually owns no properties in SA. It owns a unique asset – most of the Covent Garden estate – and originally formed part of Liberty founder Donald Gordon’s Liberty International UK property empire.

This has slowly been dismantled over time into more focused companies, including Capital & Regional (part-owned by Growthpoint). Capco’s portfolio is valued at £2.4 billion, with Covent Garden comprising £1.7 billion of this (down from a pre-pandemic valuation of £2.6 billion). It announced in June that it would merge with rival Shaftesbury to create a £5 billion estate, including tourist hotspots Carnaby Street, Soho and Covent Garden.

Fortress Real Estate Investment, with a combined market value across its A units and B units of more than R17 billion, has been steadily transforming into a REIT focused on logistics in SA and retail (both locally and through its 22.97% stake of NEPI Rockcastle, which owns malls in Central and Eastern Europe). Its current local logistics developments are focused on parks at Clairwood, south of Durban, and at Eastport, north of OR Tambo International Airport. It’s co-developing Pick n Pay’s new mammoth distribution centre at Eastport at a cost of R2 billion.

Investec Property Fund, with a market value of R8.99 billion, listed on the JSE in 2011. This happened after parent Investec sold its property-fund management and administration business to Growthpoint in 2007. The fund owns a portfolio of 86 properties in SA and a 65% interest in a pan-European logistics portfolio, with properties located in the ‘major logistics corridors of seven European countries, including the core countries of Germany, France and the Netherlands’. It has received ‘significant unsolicited interest’ from parties that want to acquire its stake in the portfolio, and it has decided to undertake a formal sales process.

Four REITs have market values of somewhere around R5 billion, namely Fairvest, Emira, SA Corporate Real Estate and Attacq. The last of these is arguably the most well-known as it is developing Waterfall City in Midrand. Aside from the Mall of Africa, it has managed to attract major blue-chip tenants to the precinct, including PwC and Deloitte.

Fairvest and Arrowhead merged earlier this year to create a mid-sized group focused on shopping centres that serve lower-income consumers. Its 78 retail assets account for half of its overall portfolio. Emira owns 77 properties across SA, with industrial and urban retail assets comprising the bulk of these. It also owns just less than half of a portfolio of a dozen US retail assets, with its share valued at R1.7 billion.

SA Corporate Real Estate has been steadily divesting its office assets to focus on convenience retail, industrial and residential properties. This stood it in good stead during the pandemic as the majority of these disposals had already happened. Its residential rental portfolio is focused on five inner-city precincts in the Johannesburg CBD.

The Schroder European Real Estate Investment Trust listed on the JSE in 2015 and is unique in that it owns a diverse portfolio of 13 property assets in Germany, France, the Netherlands and Spain. These have a total value of €215 million.

There are four smaller diversified REITs with market values below R2 billion. These include Spear REIT, which is focused on holdings in the Western Cape, Dipula Property Fund, with a portfolio of assets across the country, as well as far smaller aReit Prop and Newpark, which each hold a handful of property investments.

‘Unfortunately, the sector’s slow emergence from the shadow of COVID-19 is not one of emerging into the bright sunshine of a radiant South African economy,’ says Elston. ‘REITs are definitely seeing improving trading trends compared to 2020 and 2021, but they continue to face significant headwinds that include sluggish economic growth coupled with high inflation. Added to this is the spectre of Eskom’s constant blackouts that continue to negatively impact consumer sentiment and, of course, costing landlords and their tenants dearly in terms of emergency power-generation costs.’

He adds that several REITs are still recovering from the impact of last July’s civil unrest, and concerns remain that a repeat of the disastrous effects could reoccur. ‘On the plus side, the easing of COVID restrictions should assist in making it easier for shoppers to more comfortably return to shopping centres, and for office workers to increase their time in the office; events that will certainly alleviate some pressure on diversified REITs.’