While spending in the sector, such as gambling and fast food, is tied to economic growth, relatively small changes in GDP do not generally have a massive impact. Bigger-ticket luxuries, including motor vehicles and overseas holidays, are more vulnerable to slowing growth. Still, gambling and fast-food firms are hardly immune to the current down cycle.

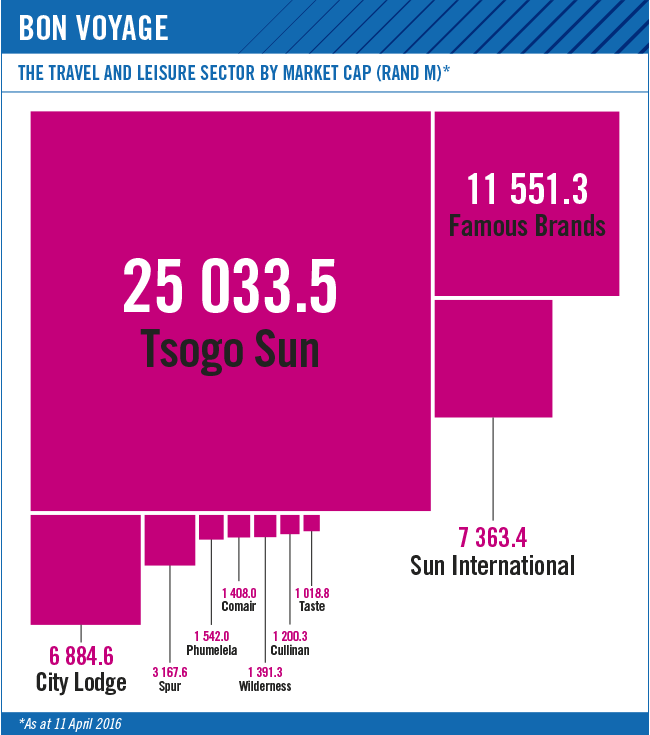

While long-standing companies such as Tsogo Sun and Sun International operate many hotels, they earn most of their money from gambling floors, sometimes located in hotels and resorts. Similarly, quick-service restaurant (QSR) operators such as Famous Brands and Taste Holdings offer the market affordable treats. When consumers are rushed, as they increasingly are, these restaurants are also able to compete head-on with home cooks for the main meal, particularly in the middle market.

Moreover, customers of both gambling and fast-food businesses pay up before consuming, making this sector a strong cash generator.

Despite the relative resilience of companies geared to the ‘small luxuries’, they are not all churning out steady profits. This is because some have chosen to expand at a time when some of the most bearish economic predictions are in danger of becoming a reality.

In general the travel and leisure sector is geared towards the middle and mass markets, but there are exceptions, such as higher end tourism products. It is no accident that touring firms are targeted at the bigger overseas market, particularly at a time of rand weakness.

According to Veneta Eftychis, senior manager of PwC’s hospitality and gaming industry unit, restaurant chains, hotels, retail and other leisure offerings are increasingly converging at big urban casinos to drive non-gaming revenue. This could see families spending an entire day at a casino – eating out, taking in a concert, shopping and so on.

To back this up, she points to the significant extension of Tsogo’s Suncoast Casino in Durban to include a destination retail mall, expanded restaurant area, rooftop swimming pools, concert venue and a bigger gambling floor.

Furthermore, Sun International is also building a R3 billion casino at the Menlyn Maine ‘integrated city’ in Pretoria.

‘The overall goal is to keep patrons entertained for as long as possible, whether on or off the gambling floor, and diverse restaurant choices and other entertainment offerings have been a major reason for successfully accomplishing this,’ she says.

Despite the resilience of the gaming sector, a localised economic crisis in one Mpumalanga town offers a foretaste of what can happen countrywide when an entire economy plunges. At Tsogo’s The Ridge Casino in Emalahleni, gaming wins fell 8.7% due to ‘significant economic disruptions to the steel industry in that area’, the group said in a report on the six months to September 2015. Were SA to suffer a severe recession on the scale of fellow commodity exporter Brazil, any assumptions of steadiness would go out the window.

Gambling houses in SA have another advantage over most other industries – barriers to entry are high. Government regulation (in this case, limiting licences) ensures this.

The converse is that any misstep by the gaming houses can result in permissions being withdrawn. Tsogo and Sun International both stress the importance of government relations in their statements. At Tsogo, the gambling performance has been relatively steady despite the stubbornly high unemployment rate in SA. In the six months to September 2015, ‘gambling win’ rose 4%’, compared to the same period in the previous year, according to the group. This growth is marginally below the country’s 2015 inflation rate of 4.6%.

Profits and revenue from the gaming segment dwarfed that of hotels, illustrating how reliant the big hotel groups are on mass-market casinos. This is true when casinos are located in cities, as opposed to ‘destination’ resorts located away from urban centres. The results illustrate the gaming bias. Tsogo gaming EBITDA was R1.62 billion. Hotel profits by the same measure were R441 million.

Rival Sun International expects the weak rand to benefit its hotel business but has been hurt by slowing revenue growth in its core SA gaming business in the 2015 calendar year.

Earlier this year, Sun International reported that in the six months to December 2015, SA casino revenue was barely changed, rising only 0.6%. Costs grew faster, according to the group.

The firm swung to a loss as expansion in a weak consumer environment proved to be poorly timed. This included heavy fees associated with the new Menlyn Maine casino being built in Pretoria and two in South America. The net loss (total comprehensive income) attributable to shareholders was R268 million versus a profit of R773 million the year before.

However, it appears Sun International has the opportunity to pick up in a couple of years if there is no further deterioration in the economy. Anchor Capital CEO Peter Armitage recently argued that the market had not priced in profits expected to flow from the Menlyn Maine casino when it opens in March 2017. Investors had been more concerned about lacklustre gaming growth, which had turned the market negative on both the sector and Sun International, Armitage told Moneyweb.

Debt at Sun International stood at R10 billion – higher than its market cap – but the firm generated positive cash flow in the most recent results. The group remains cautiously optimistic that it can simultaneously pay dividends and service its debts with one proviso.

‘The economic environment is of some concern and should it worsen, then the board will re-evaluate the payment of future dividends during this period of above-normal capital expenditure,’ Sun International stated.

Two listed firms that do earn most of their money from tourism are Cullinan Holdings and Wilderness Holdings. Cullinan owns higher-end touring businesses such as Hylton Ross, while Wilderness is an upmarket safari operator. Both are more confident about current performance after experiencing declines in foreign visitor volumes in the first half of calendar 2015.

The inbound operators are now more buoyant after fears over the Ebola epidemic abated, and the part-reversal of strict travel and leisure visa regulations. In addition, the rand was sharply weaker over the 2015/16 summer season.

‘Inbound tourism is still not back at 2014 levels but the lower oil price and weaker exchange rate provide us with some optimism for the year ahead,’ Cullinan reported at the end of December 2015.

The forward statements of both companies are peppered with positive terms such as ‘confidence’ and ‘improvement’ but these operators know better than to make commitments.

The statements are all conditional. With even the euro currency struggling in 2015, global exchange rates continue to be volatile.

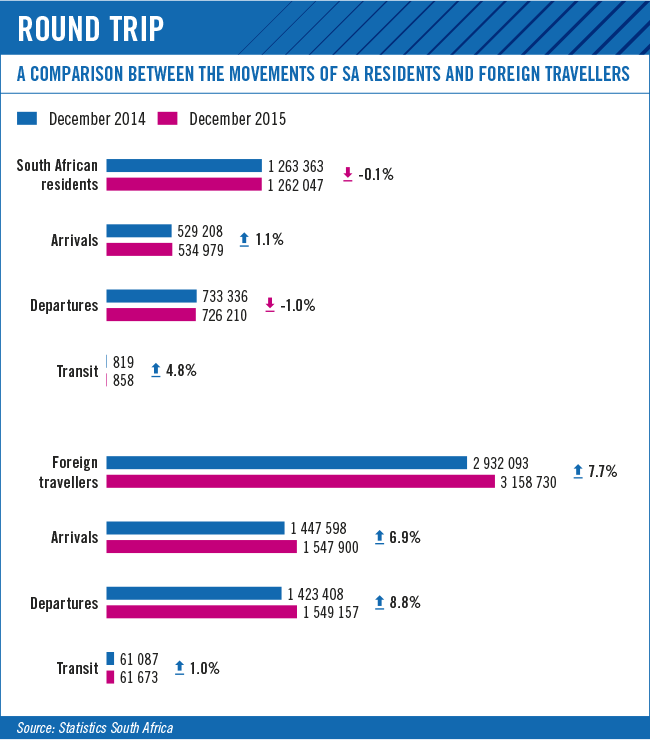

Data from Statistics South Africa confirms the more recent optimism was justified. Even though arrivals from overseas declined in 2015, the last two months were positive. There was also a small improvement in Chinese arrivals in 2015 but not enough to make up for the decline of almost a quarter in 2014, according to Lee-Anne Bac, director of advisory services at Grant Thornton.

Commenting on China, Bac said: ‘Based on arrivals in the four months [to December 2015], we are extremely hopeful that new records can be achieved quickly to bring us back on track in terms of this very important market for our nation.’

Meanwhile, City Lodge, a discount hotel group targeted at business travellers, bucked the trend by reporting strong profits in the half-year to December, BDlive reported. Occupancy and revenue also continued to rise.

Airline Comair, which earns most of its revenue from the relatively consistent market for local tourists and business travellers, benefited from the fall in the rand fuel price in the year to June 2015. However, Comair said by the second half of the financial year, the entry of start-up airlines resulted in a price war, crimping both revenue and profits. It too complained about the visa regulations impacting business from foreign visitors. From June 2015 to December 2015, this weaker trend continued as the rand fell, eroding the benefit of the cheaper US dollar price of oil.

While Comair has been a relatively steady hand in a bumpy industry, successful execution of its African strategy could add a new revenue stream. This entails meaningfully extending the partnership with global airline British Airways beyond SA, which would in turn see BA providing the intercontinental flights, and Comair the flights within Africa.

Testament to the toughness of the airline sector has been the bankruptcy of 1time Holdings (it’s still listed as liquidation processes are finalised).

On the cheaper side of discretionary spend, revenue growth at Famous Brands continued to power ahead – this as the group added businesses and continued to match consumers’ evolving lifestyles in the six months to August 2015. Revenue was up by 27% to R2 billion, while operating profit increased 14% to R347 million.

The owner of the Debonairs and Tasha’s brands emphasised it was positioned to benefit from cultural changes: ‘Despite sustained economic and household financial pressure, the food services industry registered above-inflation value growth during the reporting period, reflecting that eating out has become part of the fabric of the social lives of the majority of middle-income and high-income consumers in South Africa,’ the group stated in its 2015 interim results report.

However, profit margins were off record highs achieved in the year to February 2015 as it struggled to integrate the new Gauteng distribution centre into the supply chain.

‘The operating margin declined to 17.4% primarily as a function of margin erosion in the logistics business,’ reported Famous Brands. While the group benefited from the record economic expansion up to 2009, it has also managed to tap into trends in the slow growth environment since then, including breakfast and dinner in full-service restaurants.

Manufacturing and supply chain ownership has also set the firm apart, with profits from these businesses not far from those earned from stores. Curiously, the group has also been wary of taking on debt to fund expansion, giving it a defensiveness that rivals consumer staples such as supermarkets.

Testament to the success of Famous Brands – and to some extent the QSR sector in general – is the fact that home-grown imprints, with the exception of the established KFC chain, continue to dominate. Predictions that the mighty McDonald’s group would quickly erode Famous Brands’ market share proved way off the mark as McDonald’s struggled without an experienced local partner. Despite McDonald’s uneven start in SA more than 20 years ago, the brand is now established in major urban centres. Newer US entrants, including Burger King, will continue to test SA brands.

Famous Brands’ smaller rival, Taste Holdings, has recently taken a calculated bet that global brands will set it apart from indigenous marks. It will tackle a new chapter this year when it starts rolling out the powerful Starbucks coffee brand, for which it has acquired the local rights.

The combination of Starbucks’ expertise and Taste Holdings’ local knowledge has the potential to be a winning formula for the group. However, in SA, unlike the US, Starbucks will not have the first-mover advantage of having been the trendsetter in speciality coffee.

While the sector in SA is already teaming with niche innovators, Starbucks may have stronger appeal in the big middle market.

Still, establishing brands to global specifications comes with costs. Taste Holdings said it had continued to lose money in the year to February 2016 after outlays relating to implementing the Starbucks and Domino’s Pizza brands in SA.

Meanwhile Spur Corporation is continuing to focus on international expansion in the rest of Africa, at a time when many consumer firms are scaling back on the continent in favour of investment in Europe. The change follows the collapse in commodity prices. Spur’s move includes pioneering investment in Ethiopia, one of only a handful of countries still growing at 10% (according to the IMF), but one that has only recently started to open up to investment.

Horse racing gambling operator Phumelela Gaming and Leisure reported a 28% decline in attributable profit after unsuccessful investments in the Nigerian and Mauritian markets pulled profits down to R80 million in the year to July 2015.

The group has now had many years to contend with the legalisation of casinos and revenue has of late been stable. According to Phumelela, it has ‘minimal’ net debt of only R6 million.

In these uncertain and volatile times many investors will favour those firms in the travel and leisure sector with consistent profit generation and relatively low debt. However, the prospects of those still paying off recent investments will be more intriguing. They have greater potential for both upside and downside.

A combination of the country’s economic trajectory, management skill and luck will determine the winners and losers.

By Tom Robbins

Image: Greatstock/Corbis

If you ever find yourself in Johannesburg, be sure to check out The 20 Best Restaurants in Midrand.