One of the proven methods of reducing risk is diversification. SA’s main insurance companies, in both the long- and short-term spaces, are taking this option in the face of a slow-growing local market. Strategies involve new acquisitions, offshore diversification and moves into new areas of business, notably banking. Technology is also playing a greater role in products and services. But as the industry hardens rates and imposes tougher conditions on clients, it also faces growing competition from other players in the financial services industry.

In June, Capitec Bank, for example, started offering life insurance, adding to its funeral and credit card cover. The bank obtained its insurance licence in 2023 and has already issued more than half a million new policies. Moving in the opposite direction, SA’s fourth-largest insurer (by market cap), Old Mutual, announced in April that it had been granted a banking licence. It appears to be counting on the brand loyalty of its 3.1 million low- and lower-middle-income clients. The mutual penetration of banking and insurance is not new. Discovery, originally a health insurance provider, launched a digital bank in 2020.

A 2023 report by professional services consultancy Aon notes how a hard market increases risk, premiums and exclusions.

‘A “hard” insurance market refers to a period in the insurance cycle characterised by higher premiums, stricter underwriting standards, and reduced capacity for coverage,’ according to Motshabi Nomvethe, head of technical marketing at insurance firm Professional Provident Society (PPS).

Nomvethe argues that ‘in the next couple of years, both long-term and short-term insurers in South Africa are likely to face a landscape shaped by regulatory pressures, economic uncertainties, and significant opportunities driven by technological advancements, changing consumer expectations and evolving market dynamics’.

Environmental insurance risks have jumped the queue in SA as well as globally. Old Mutual Insure chief actuary Ronald Richman says ‘it is not far-fetched to believe climate change has the potential to destabilise the global insurance industry, with ripple effects for South Africa’. In 2023, Old Mutual had to deal with 10 weather-related events, with three of these classified as significant. These three events saw the company pay out R350 million.

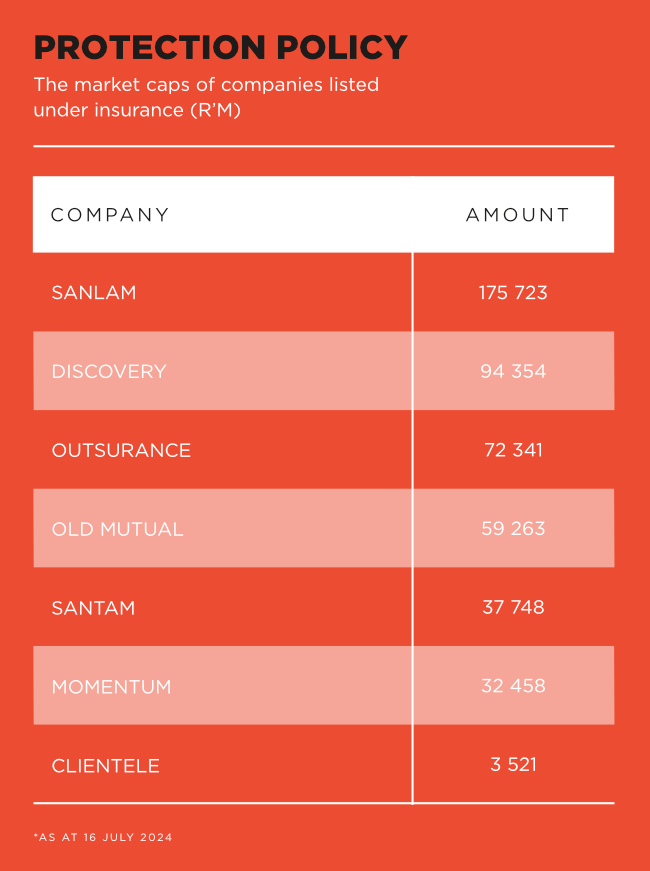

What is especially notable about the elevated risk in the SA environment is that it does not seem to have necessarily dented the bottom lines of the country’s major listed insurance companies. SA’s biggest insurance company, Sanlam, reported a 15% increase in new business volumes in its life insurance business for the first quarter of 2024. This follows a stellar performance in 2023. Net profit reached R12.4 billion, an increase of 18% on 2022. Sanlam’s share price has risen from R58 at the end of June 2020 to around R80 in mid-2024. The company’s market cap is now about R176 billion, an increase of R40 billion over the four years. Sanlam’s sister company, short-term insurer Santam, also saw ‘resilient’ results for 2023. The company was able to report a 9% growth in group insurance revenue and 17% in overall profits.

Sanlam’s results speak less to the SA risk environment than to the company’s strategy since 2020. It has been on an expansion spree. The company refers to ‘the three pillars’ of its strategy – consolidating the SA market, expanding in Africa, and building on its toe-hold in the Indian market. Sanlam claims to be the largest insurer in Africa with a footprint in 22 African markets outside SA.

One of these is Egypt, which Sanlam accessed last year through a joint venture with Europe’s biggest insurance company, Germany-based Allianz. The venture, known as SanlamAllianz, houses the two insurers’ pan-African financial services operations. The initial shareholding split was 60% to Sanlam and 40% to Allianz, based on equity contribution.

Sanlam’s recent acquisitions and partnerships in SA read like a cross-section of the industry. They include AfroCentric, a black-owned investment company active in the healthcare market. Sanlam increased its stake from 29% to 60% in May 2023. Last year, Sanlam also acquired full control of life insurance provider BrightRock, paying R399 million to increase its stake from 62% (purchased in 2017) to 100%.

Also last year, Sanlam bought fiduciary services company Capital Legacy, in which it already had an indirect stake through its holding in African Rainbow Capital Financial Services. In addition, rounded up in the 2023 burst of acquisitions was Assupol, a company that has its origins in providing funeral cover for members of the SA police force since before World War I. The R6.6 billion transaction gives Sanlam greater access to the low- and lower-middle-income markets.

Looking ahead, Sanlam’s brightest prospects, may well be its Indian investments in the Shriram Group, which it first bought into in 2013. The SA giant increased its holding in Shriram’s life and general insurance entities to more than 50% in April this year.

Given the SA economy’s faltering performance, international diversification may yet pay off for Sanlam. ‘Performance is underpinned by the commitment of our people and the diversity of our operations by product, market segment and geography, coupled with excellent cash generation and the group’s solid financial base,’ according to CEO Paul Hanratty.

Sanlam’s traditional rival, Old Mutual, has performed much less spectacularly in recent years. But its latest results are encouraging. In March, Old Mutual reported a 28% rise in earnings compared to 2023. The company was the first major SA insurer to test the waters offshore, when it demutualised and listed in London in 1999. The move was widely viewed as disastrous, costing shareholders more than R100 billion and culminating in a return to a Johannesburg primary listing in 2018.

The demerging of Quilter, previously Old Mutual Wealth, in 2016, and the insurer’s disinvestment from Nedbank at the same time, appears to have left Old Mutual strongest in the low- and lower-middle-income sectors of the market. This is where its new bank offering is focused. However, the company may have lost business to newer, more tech-savvy operators.

Foremost among these is Discovery, founded as a health insurance specialist in 1992. Its operating model assumes clients can be incentivised to make healthier lifestyle choices through its Vitality wellness programme. This has now spread to other linked incentives, such as cheaper airline tickets, motor insurance and fuel. Discovery appears to be the personal insurer of choice among SA’s white-collar professionals.

This status is reflected in Discovery’s numbers. It is now SA’s second-biggest insurer by market cap (R94 billion). Its results for the second half of 2023 have been described as ‘resilient’ although they do show how slow the SA market is. Discovery Vitality grew 9% in SA and 13% in the UK, while Vitality Global produced a massive 71% improvement. The business, which Discovery described as ‘the world’s largest behavioural health platform’, is active in 30 markets including the US, Canada and Australia.

Discovery is praised by brokers for technological innovation. Queries receive responses from ‘bots’, which are said to be highly effective, while the less innovative Old Mutual still utilises call centres, which are said to involve lengthy queues. The ethos of the insurance industry has shifted from what has been described as ‘repair and replace’ to what is more of a ‘predict and prevent’ approach, which requires more analysis (using big data) and more interaction with clients. In SA, it is the smaller, newer insurers that look best placed to utilise technology.

‘The life insurance sector is experiencing a technological revolution, with AI now playing a critical role in underwriting and customer service. Data analytics is being leveraged to tailor policies and assess risks more accurately,’ says Nomvethe.

‘Insurers are investing heavily in technology platforms and partnerships to enhance customer experiences, aiming to offer streamlined services and affordable, personalised products that cover life, health, and wealth.’

OUTsurance is originally a short-term insurance specialist and SA’s third-biggest insurer by market cap. Reflecting the slow local market, its results for the six months to December 2023 were relatively weak, with normalised earnings up only 0.5%. These numbers incorporated OUTsurance’s Australian subsidiary, Youi, and OUTsurance Ireland, which also struggled.

Momentum, the sixth-biggest listed insurer on the JSE by market cap also did well in 2023, with a 48% increase in overall profits. Momentum is another tech-savvy company that uses a behavioural model reminiscent of Discovery’s.

The small niche insurer Clientele (market cap R3.5 billion) appears to have struggled, with insurance revenue for 2023, down 5% on the 2022 figure. But the funeral policy and entry-level specialist is also taking part in an acquisition drive. It is currently in the process of buying 1Life, a move that will double its client base.

The SA insurance market might be going through a difficult phase, but this does not mean companies in the sector are inactive. Most insurers are looking highly capable as they search for alternative paths forward.