Two seemingly related sub-sectors, containers and packaging on the one hand, and diversified industrials on the other, both have lessons on manufacturing, offshore investment and coping with local headwinds such as energy security in the current SA market.

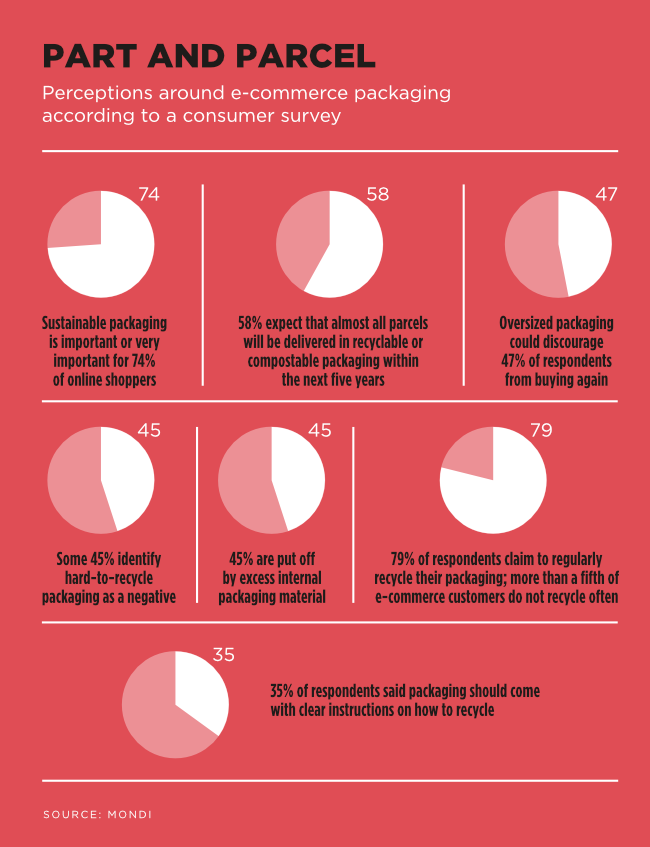

Two years ago, the containers and packaging sector was flying in the general industrials sector of the JSE. ‘Packaging recovered faster from COVID than many expected,’ says Anchor Capital analyst Seleho Tsatsi. ‘E-commerce – which was accelerated by the pandemic – is cited by many as a driver of demand in the sector,’ he says. He adds that it is still considered an important factor and one that has perhaps not yet lived up to its full potential in the SA economy.

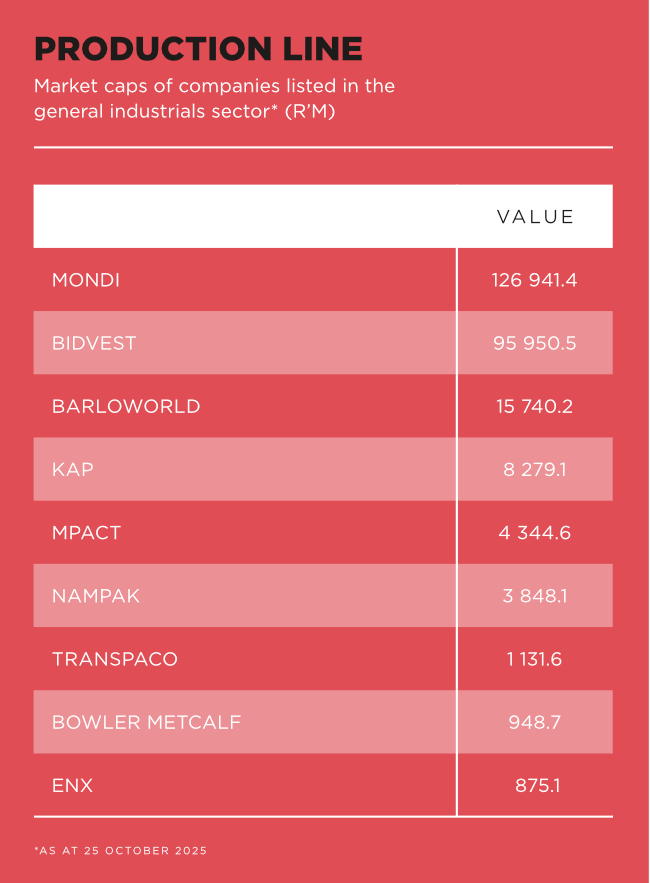

The giant of the container and packaging sub-sector is Mondi, which is dual listed on the London Stock Exchange (LSE) and the JSE. ‘Mondi is a strong company, although it has yet to relive the peaks of 2022,’ according to Tsatsi. Mondi, which has a market cap of around R127 billion, could in fact buy the rest of the JSE’s packaging sector for less than one year’s operating profits (about R12 billion). But Mondi, which started life in the late 1960s as a Durban-based paper packaging mill, is hardly exposed to the SA market currently. Mondi’s listing on the LSE, in 2007, was part of a process of European expansion, which had already started before this – the company began investing in Polish and Austrian assets as long ago as 2000.

‘Only 12% of Mondi’s revenue comes from Africa,’ points out Tsatsi. By contrast, he says, 68% is earned in Europe. The major handbrake over the past four years has been its Russian interests which, according to Tsatsi, accounted for 9% of revenue in 2021. Russia was hit by sanctions at the start of the war in Ukraine. ‘Mondi is now fully out of Russia,’ says Tsatsi. Its sale of three package-converting operations and a pulp mill in the north of Russia took time and may have been conducted at a discount. The company is now investing in projects in Italy, Finland and Poland, which it expects to drive organic growth in the European market.

A different offshore strategy was more problematic for another well-known name in the sector, Nampak. Describing itself as ‘Africa’s leading diversified packaging manufacturer’, the company has been listed since 1969 and operates from 19 sites in SA (currently accounting for 68% of group revenue) and 14 sites elsewhere in Africa (32% of revenue).

Nampak has, however, struggled in recent years. The company’s share price has fallen by 80% since 2019, and last year share tipster the Finance Ghost observed that Nampak, which had a market cap of R630 million at the time, is ‘officially a small-cap share’. The same pundit observed that ‘it has been a truly horrible story of value destruction’.

Nampak’s problems started when it chose to expand into sub-Saharan Africa in search of the sort of growth levels that have proven elusive in SA for longer than a decade. Major investments included the establishment of a beverage line factory in Angola in 2011 and the purchase of a packaging company in Nigeria in 2014. Nampak was a major supplier to companies such as Coca-Cola and South African Breweries in these markets and others on the continent.

However, the African expansion ran into a number of difficulties. In a letter to shareholders last year, former chairman Peter Surgey wrote that ‘the “Africa Rising” narrative, which we had followed with large investments in Nigeria and Angola, failed to take off. The investments initially went well with excellent facilities constructed. Sadly, the forecast acceleration in economic growth did not materialise, and the economies of both countries declined steadily. These declines were compounded by Zimbabwe, where Nampak has an excellent business but has been unable to externalise any dividends for years’.

Nampak may be on the road to recovery, with a successful R1 billion rights issue, which closed in mid-September, and a new CEO in ‘turnaround artist’ Phil Roux. Significantly, Roux chose to invest his R5 million sign-on bonus in the company’s shares. The rights offer is intended to reduce the company’s R4.5 billion debt pile and pave the way for the selling of non-core assets.

It may be that packaging companies that chose to stick to their local knitting in SA made the wiser decision. Mpact, which was spun out of Mondi in 2011, provides a good example. Although currently trading lower than its 2016 high, it has steadily focused on organic growth in the SA market and, as a result, delivered much steadier returns than some of its peers. The company has steadily gotten on with local investment and was an early adopter of renewable energy alternatives, which has largely freed it from SA’s energy security concerns. But even Mpact, with its local focus, has had to deal with the weakness of the local consumer market. It has chosen to cut exposure to this vulnerable sector and focus more on things such as packaging for SA’s thriving fruit export sector.

‘We’ve spent the last number of years rearranging our portfolio to increase our exposure to sectors that are less dependent on consumer spending in South Africa,’ CEO Bruce Strong said in an interview with Business Day earlier this year.

The two other companies in the container and packaging sub-sector have maintained their local focus. Cape Town-based Bowler Metcalf, a plastics packaging specialist, has continued to earn a consistent profit as it has every year since it was listed in 1987. Transpaco has also performed steadily, although, like its peers, the heavy load shedding in 2023 impacted on its gross revenue. The company is sitting on a cash pile and looking for acquisitions. However, it is not interested in expanding into Africa, which rules out buying some of Nampak’s assets.

The diversified industrials sub-sector is affected by some of the main dynamics visible in containers and packaging, notably the complexity of offshore diversification and the slow growth of SA’s domestic market. This is part of the reason for the divergence in share price performance between the two biggest companies in the sector. Bidvest (with a market cap of about R96 billion) has appreciated 47% over the past three years, while Barloworld (R15.7 billion market cap) has dropped 30% in the last five years.

The giant in diversified industrials is Bidvest. It is probably easier to identify industries in which it not active than to list those in which it is. Bidvest’s 2024 sustainability report lists 365 wholly owned subsidiaries on multiple continents in a vast range of services, distribution, sales, rental, logistics and trading activities. Across the group, the things that get done range from selling cars to cleaning restrooms to catching fish. The company employs more than 130 000 people.

The sheer diversity of Bidvest’s activities and locations is a hedge against risk in itself. But beyond this, the company insists that it has a distinctive operating model that facilitates success.

The group describes this as ‘decentralised and entrepreneurial’, which is code for saying that it buys good subsidiaries and keeps the best of their management. Bidvest says that the many related and interacting businesses constitute ‘an ecosystem […] that actively supports and adds value to our customer base, focuses on cash generation and returns’. Size is an advantage in that there is little restriction on inventory availability compared to smaller competitors that might struggle in this area.

In May, Bidvest reported a 5% rise in headline earnings for the second half of 2023. Five of its seven divisions reported growth of at least 10% in trading profit.

Barloworld, with its focus on industrial equipment and consumer industries, does not have the diversification options available to Bidvest. However, it has branched into countries where its role as an agent for US giant Caterpillar finds a market. Barloworld Mongolia grew revenue 43% in the last year, driven by the massive expansion of the Mongolian coal mining industry. This year, Mongolia has displaced Australia as China’s biggest coal supplier.

Barloworld has, however, struggled on a couple of fronts. Its Equipment Southern Africa subsidiary reported an 8% drop in earnings halfway through the current year. This reflects a drop in capital expenditure in the SA mining sector and the slow take-off of government’s big infrastructure ambitions.

‘Our South African operations have had to contend with the constrained local macro-economic environment, with inflationary cost pressures as well as the relatively higher borrowing costs affecting both business and households,’ CEO Dominic Sewela said in an interview in May.

Russia, which accounted for one-fifth of Barloworld’s revenue in 2022, is subject to international sanctions.

In September the company submitted a voluntary self-disclosure over potential export control violations to the US Department of Commerce. This resulted in a 12.5% slump in the company’s share price on the JSE in mid-September. Barloworld had previously (in 2022) written down the value of its Russian operations by more than R1 billion.

A contrasting set of dynamics underpins the performance of diversified manufacturing and logistics group KAP, headquartered in Stellenbosch. The group, which owns well-known SA brands such as PG Bison, polymer producer Safripol and logistics specialist Unitrans, has engaged in large-scale capital expenditure (totalling R8.5 billion) in the SA jurisdiction over the past decade.

It intends spending R1.3 billion in 2024, much of it on expanding capacity at the wood-based panels and furniture manufacturer PG Bison.

KAP’s share price has dipped since 2022, but not catastrophically. Yet the company’s capital spending programme suggests a commitment to the domestic market, which will pay off if local trading conditions improve.

The smallest company in the JSE’s diversified industrials sub-sector is the enX Group, which focuses on leasing and fleet management, with a sideline in energy solutions. It has performed well this year, partly driven by SA’s transition from rail to road. enX was able to pay a special dividend in June after selling one of its tanker trucking operations, Eqstra, to Nedbank for R1.1 billion.

Overall, these two sub-sectors show that while smaller, more locally focused firms are positioned to benefit from any growth leveraged by SA’s new, reformist Government of National Unity, there are probably still underutilised niches that they can move into.

The strategic alternative would appear to be offshore diversification, which is never bad news but, as the experience of several of these players shows, can be fraught.