South Africans have always felt that they have a special relationship with Mauritius. It has loomed larger on SA’s radar than any other of the Indian Ocean islands – Seychelles, Reunion, the Maldives or Madagascar – and there are good strategic and economic reasons for this.

Mauritius offers a growth model to the African continent. ‘We chose a very strong, growth-oriented development path after independence in 1968,’ says Vijaye Lutchmun, Mauritian high commissioner to SA. He notes that GDP per capita in Mauritius has soared from $400 per person at independence to $12 740 in 2019, adding that forecasts suggest the figure will be close to $20 000 by 2023.

‘COVID was, of course, a setback for growth, as it was everywhere in sub-Saharan Africa, and has made our future trajectory less certain,’ says Lutchmun. However, he argues, ‘the combination of political stability, a strong institutional framework, together with bilateral and multilateral trade and investment agreements and open-trade policies are the key to sustainable growth’.

South Africans tend to think of Mauritius as a holiday destination but there is much more to the island than tourism. ‘Mauritius has transformed from a mono-crop – sugar – economy in 1968 into a competitive, well-developed and growth-based economy,’ says Lutchmun. ‘We’re open to investment across 15 sectors, including tourism, agribusiness, manufacturing, logistics, the ocean economy, healthcare and pharmaceuticals, real-estate development, hospitality, ICT, creative – especially film – infrastructure, tourism development and education.’

He adds that more recently ‘Mauritius has become a sophisticated, transparent and well-regulated financial hub’.

Not that tourism or SA’s role in it should be underestimated. The sector accounted for about 20% of the island’s GDP in 2019 and provided 100 000 jobs before the COVID-19 pandemic devastated the industry. That year, Mauritius attracted more tourists (1.4 million) than its permanent population.

South Africans account for about 10% of Mauritius’ tourist numbers and have made up at least that proportion since South African hotelier Sol Kerzner practically launched the industry when his company, Sun International, opened the Le Saint Géran hotel in 1975 and La Pirogue the following year. However, an important sign of the way Mauritius works is that Sun International was not acting in isolation but responding to an act passed by the Mauritian government focused on development incentives. Since then, literally millions of South Africans have enjoyed a package holiday on the island.

Tourist numbers in Mauritius were devastated by COVID-19, which effectively shut down the industry. The pandemic also saw Air Mauritius being placed under administration as its primary business had simply disappeared. The government of Mauritius responded with a comprehensive vaccination campaign that covered a remarkable 90% of the population by May 2022. At the same time, it provided a massive fiscal stimulus (equal to 28% of GDP) mostly to the stricken sector, including $400 million in ‘wage support’ to individuals and small businesses, especially in tourism. It was phased out in April 2022.

While the industry hasn’t quite recovered to where it was before the pandemic, figures provided by the South African Chamber of Commerce in Mauritius suggest that the number of tourists was back to about 1 million for 2022 – 96 400 of these were South Africans.

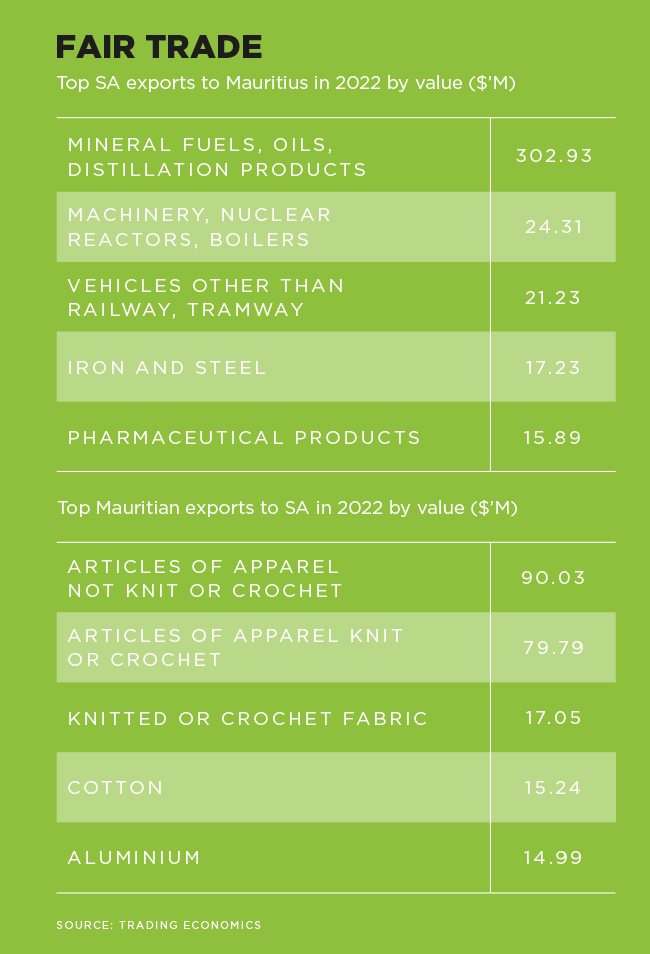

SA is Mauritius’ third-largest trading partner, behind only China and India. But trade figures are small. SA’s exports to Mauritius, valued at $615.6 million in 2022, rank the island nation somewhere in the mid-40s as a trading partner.

The situation is rather different from a Mauritian perspective – SA provides the country’s third-biggest overseas market for manufactured goods, especially textiles produced in the island’s Freeport industrial development zone.

The economy of the Indian Ocean island is in fact tiny compared to SA’s. Its GDP is just 3% of SA’s and its population, at 1.3 million, only 2%. But Mauritius punches above its weight. It has deliberately set out to be an intermediary and trading post, situated between major Asian economies, especially India, and the rest of the world. The current implementation of the African Continental Free Trade Area agreement (AfCFTA) offers a whole range of new opportunities, offering, as it does, a potential market of $3.4 trillion.

The Mauritian government amended its nationality act in July 2021, making it easier for foreigners to acquire permanent residence. A business investor permit can be obtained for an investment of as little as $50 000, which is a pittance compared to other jurisdictions that allow ‘residence-by-investment’, often referred to as ‘golden visas’. Mauritius has also offered remote working visas (called premium travel visas) since October 2020.

Fifty years ago, Mauritius was a vulnerable, poor, single-crop island economy. It produced virtually nothing other than sugar, and the few foreign visitors were mostly stop-over passengers from Qantas and SAA flights between Australia and SA. Mauritius’ primary asset, however, has always been its strategic location. This is why it was incorporated into the British empire in 1810.

Today, Mauritius is at – or close to – the top of all rankings for good governance and economic development in Africa. However, as Ronak Gopaldas of Johannesburg-based consultancy Signal Risk notes, ‘Africa represents a strategic pivot for Mauritius, not a core identity’. Gopaldas openly asks whether Mauritius should be considered an African country at all. Its trade is with the world and its cultural links are strongly Indian. About two-thirds of the population has Indian ancestry.

He points out that ‘Mauritius has transformed from an agrarian to a manufacturing to a service-based economy through a series of smart decisions and pragmatic policies’. Over the past 50 years, the government of Mauritius has proven effective ‘at managing the risk inherent in being a small open island economy’, he says.

Lutchmun prefers to see Mauritius as a unique blend of different cultures. ‘South Africa is called the “Rainbow Nation” but that has been an appropriate description of Mauritius for a very long time,’ he says. Each wave of colonialism and development brought a new layer of culture. ‘Creole, French, English, Indian and, more recently, Sino-Mauritian all live in harmony.’

The important decisions were about being open to the global economy. Mauritius signed a double-taxation avoidance treaty with India in 1982. As Mauritian taxes are lower than those of India – with corporate taxes being 15% and no capital gains tax levied – it made sense for foreign institutional investors (including hedge, mutual and pension funds) to domicile themselves on the island.

Between 2000 and 2015, 34% of foreign direct investment into India came from Mauritius, a total of $93.6 billion. Kevin Teeroovengadum, a Mauritius-based economist, points out that ‘we must be careful, as it is not necessarily Mauritian investors investing in India, but rather global investors routing their investments via Mauritius to invest in India’.

Teeroovengadum says that since the double-taxation treaty with India was revised in 2016, other tax-friendly jurisdictions – notably the Cayman Islands and Singapore – ‘have taken market share from Mauritius’. Last year, Mauritius was the third-largest source of foreign investment into India, accounting for $9.4 billion (16% of the total). This ranks behind only Singapore ($15.9 billion) and the US ($10.5 billion). But this is much lower than the $16 billion that flowed through Mauritius to India in 2018 when the island economy was the top-ranked investor.

The island has double-tax avoidance treaties with 45 other countries, the most recent being signed with Angola in 2022. More than 15 of these treaties are with African countries, with another seven under negotiation. Capital flows via Mauritius will undoubtedly be a considerable part of Africa’s future.

Gopaldas argues that capital flows into Africa via Mauritius have been ‘steadily rising since 2000’, with the island accounting for about half the total volume. In 2016, ‘nearly half of the total inbound investments for Africa went through Mauritius’, he says.

The big question for the future of the island is whether capital flows to Africa can compensate for the drop in business with India.

Mauritius’ banking and finance sector was briefly threatened in February 2020 when the country was placed under enhanced supervision – ‘greylisted’ in popular jargon – by the Financial Action Task Force. Greylisting, if in place over a substantial time, threatens to tie up financial transactions in red tape. But Mauritius tightened regulatory supervision and came off the grey list in record time. The island was under enhanced supervision for just 20 months.

Companies located in SA are taking a hard look at how to use the potential of the AfCFTA. They may well find that an important part of their journey into the African continent runs through Mauritius.