Water management has long been a focus in the mining sector, with the International Council on Mining and Metals’ (ICMM) water-stewardship framework outlining a standardised approach for mining companies as early as 2014. The ICMM defines water stewardship as the use of water in ways that are socially equitable, environmentally sustainable and economically beneficial. Indeed, there is ongoing pressure for mining companies to prioritise the sustainable and responsible use of water resources, and to focus on water security. In SA, companies have stepped up.

‘Effective water stewardship is all about reducing the mine’s freshwater usage,’ says Peter Wille, team lead of water treatment at Golder Africa, a member of WSP Africa. ‘This includes taking into account the current, future and post-closure usage. Effective water stewardship does not only relate to the current status quo but also adapting your mining processes, taking post-closure water liability into consideration. The principle of incremental improvement in water management is part of the process of developing the water-management roadmap, taking the holistic basket of available solutions into consideration.’

Grant Stuart, senior VP of environment at Sibanye-Stillwater, says the key components of a successful water-management strategy include a clear understanding of the specific water-use context across all of the company’s operations down to site level, along with effective monitoring and reporting systems. ‘A granular and comprehensive understanding of our impact, risks and opportunities within a local, regional and global context is necessary, along with a strategy and plan, based on performance objectives, to ensure sustainability of water as a finite resource,’ he says.

Sibanye-Stillwater’s water security and independence management strategy has progressed considerably in recent years. Most notably, says Stuart, there has been a significant improvement in the understanding of water risks and opportunities, and improved accounting of water use through monitoring and reporting, as well as better defined action plans with demonstrated step-change performance in accordance with remuneration-linked performance objectives. These have led to a 40% reduction in potable water purchased by the SA gold operations since 2017, and a 20% reduction in potable water purchases at the SA PGM operations.

The company faces distinctly different water challenges at each of its operations globally. At its SA PGM operations, located in the water-stressed North West province, third-party utilities provide 61% of the water required – the majority of which is sourced from the Vaal river system. By contrast, its SA gold operations in the West Rand, Gauteng, are overlain by dolomitic aquifers and are largely water-positive due to the ingress of significant volumes of this water. To optimise the use of this natural bounty and reduce the purchase of water from third-parties, the company has installed borehole and water-treatment plants at its Ezulwini, Kloof and Driefontein operations, with Phase 1 of the Kloof 8 shaft water-treatment plant independence strategy completed, and the Driefontein water-treatment plant upgrade in progress. The latter will ensure complete independence from municipal supply by Q3 2022.

Climate change and related impacts have a significant influence on Sibanye-Stillwater’s Water Conservation and Water Demand Management (WCWDM) approach, with changing laws and regulations largely supporting its strategy, says Stuart. ‘In fact, it highlights the importance of the focus we are applying to responsible water-management practices. We are continuously ensuring that our position, strategies and plans are robust and support the building of a climate-change resilient business.’

Stuart says that for 2022, the company is targeting a reduction in its water demand from the Vaal river system by 15% compared to a 2020 baseline. ‘Further to this, we set targets to reduce the reliance of operations on third-party potable water sources in water-rich jurisdictions to 10%, and in water-poor jurisdictions to 40% by 2030,’ he adds.

‘Managing our impacts on water catchment areas – by ensuring that we do not reduce the quality or volume of water in the areas surrounding our mines – is key to maintaining our social licence to operate,’ says Sven Lunsche, VP of corporate affairs at Gold Fields. ‘Water is not only a vital resource for our ore-processing activities but is also essential to our host communities – particularly where agriculture is an important economic activity. As such, managing our water resources is critical.’

During 2021, Gold Fields spent $32 million on water management and projects across the group (compared to $25 million the previous year). At an operational level, the miner continues to invest in methods to improve water-management practices, including pollution prevention, recycling and water-conservation initiatives. South Deep continued to recycle treated sewage effluent, which was previously discharged. The mine also upgraded its potable-water pipeline to reduce water losses.

Water performance during 2021 was a significant highlight for the group, as total freshwater withdrawal declined by 6%, helping to put Gold Fields on track to achieve its 2030 target of a 45% reduction. As part of the company’s launch of its 2030 ESG targets in 2021, two overriding water-management targets were set, namely to reduce freshwater usage by 45% from a 2018 baseline, and to recycle and reuse at least 80% of used water. Implementation of the group’s 2020–2025 Water Stewardship strategy, which comprises several key pillars, including security of supply, water efficiency and catchment-area management, was also continued, supported by detailed regional water-management plans.

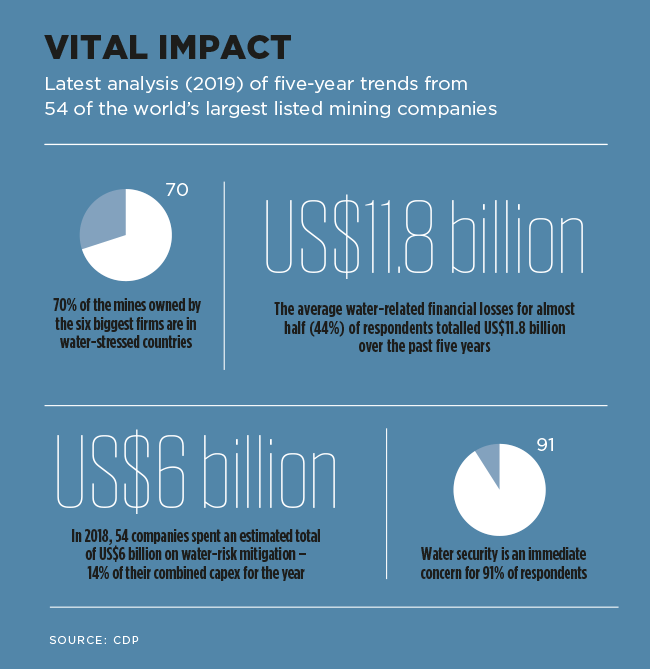

Gold Fields benchmarks its water usage by participating in the CDP water-disclosure programme. During the 2021 assessment, the company achieved an A– ranking – one of only 118 high-performing companies from about 6 000 that were scored.

Tsakani Mthombeni, group executive of sustainability at Implats, says that failure to establish water security is a group Top 10 risk. ‘Our efforts in 2022 with respect to water management are primarily aimed at addressing this risk. We are exploring alternative water sources for our operations, optimising processes to minimise water usage and improving internal water reuse and recycling to above 56% by 2025,’ says Mthombeni. ‘Our other priority in 2022 is to establish a group water-management policy statement to provide guidance to all our operations, including Zimbabwe and Canada, with respect to water management.’

Implats’ strategy focuses on reducing water risks to ensure resilient operations, while also minimising its water footprint. Key objectives are to reduce freshwater withdrawal, improve recycling and reuse, and prevent Level 3 and above water-related incidents.

The company has operation-specific water-conservation plans. At Impala Rustenburg, for example, which accounts for 50% of the group’s total water consumption, a specific focus is placed on managing water, and the use of alternative water resources in its processes is prioritised. Its recycled water includes tailings return water, captured rainwater and internal purified sewage effluent (greywater). Impala Rustenburg is currently also researching alternative water sources for usage and storage capacity with the potential to minimise production losses. The operation is building a 25 Ml water reservoir at a cost of R180 million, and spending a further R105 million on stormwater separation infrastructure.

Implats also participates in the CDP water disclosure programme, and received an A score for its submission for two consecutive years.

Its highest scores were attributed to risk assessment, risk exposure and responses, business strategy, governance, integrated approach to environmental challenges, targets and goals, and water-related opportunities.

Melanie Naidoo-Vermaak, senior executive for sustainable development at Harmony, says the company takes a risk-based approach, internalising risks and opportunities at asset level, as well as within regional geographies, and managing these through the life cycle of the business.

‘We take a systematic and interdisciplinary approach to water stewardship by looking at it across engineering, environmental, economic and social dimensions to maximise outputs and shared benefits,’ she says.

Water management at Harmony’s operations is underpinned by robust water balances that inform usage and management, according to Naidoo-Vermaak.

‘It looks at water security for business continuity and future growth, water quality and pollution prevention; optimised usage through the hierarchy of management, as well as beneficiation of water and availability for societal use.’

As for how the water-management plan has changed in the past few years, she says Harmony has been driving efficiencies and recycling as best as possible and moving to zero discharge.

Asked about the impact of changing laws and regulations regarding waste disposal in mining, which includes water, Naidoo-Vermaak says that some of these have a techno-financial impact on the company’s business, and that the miner usually engages regulators upfront. ‘More often than not, though, we look to the opportunities that could be leveraged, as in the case of climate change, for example,’ she says. ‘Climate change can present both risks and opportunities, and in managing this issue, we have found that we can deliver the dual impact of doing good and generating value for the company. By the same token, in capitalising on these opportunities, we should be able to bank our compliance agenda as well.’

Golder Africa’s Wille says the most recent changes to environmental laws and regulations concerning waste are driven by the large mining companies’ self-regulation.

‘There has been increasing pressure from regulators to tighten up on mine-waste regulation over the past few years,’ he says. ‘Conversely, resistance from industry to such tighter regulation would come with considerable additional cost, particularly on ongoing operations where regulatory changes cannot be retrospectively applied or are difficult to apply retrospectively. The regulatory environment remains very fluid.’

He adds that flexibility in the approach followed is critical ‘to be able to adjust to unknown changes that may follow as a result of global warming impacts’.