A PwC report on pharmaceutical companies and challenging business models in the run-up to 2020 notes that, to prosper, they ‘need to improve their R&D productivity, reduce their costs, tap the potential of the emerging economies and switch from selling medicines to managing outcomes’. In the years since the release of that report, emerging economies have certainly come into their own in this space, and Africa is no different.

In fact, according to research consultancy Goldstein Market Intelligence (GMI), Africa is the only pharmaceutical market where genuinely high growth is still achievable. The value of the continent’s pharmaceutical industry jumped to $28.56 billion in 2017 from just $5.5 billion a decade earlier, according to GMI. ‘That growth is continuing at a rapid pace: we predict the market will be worth $56 billion to $70 billion by 2030.’

Referring to SA specifically, Stavros Nicolaou, senior executive: strategic trade at Aspen Pharmacare, says that the country ‘has one of the most disproportionate global disease burdens, which some describe as a possible collision course between highly prevalent infectious diseases such as HIV/Aids and TB on the one hand and a rising pandemic in NCDs such as diabetes and hypertension on the other’. This presents significant challenges to an already overstretched healthcare system, he adds, which is likely to be ‘further stretched at a time when the COVID-19 pandemic is exposing healthcare system frailties all over the world’.

Increasing demand for more targeted and customised therapy is placing further pressure on scarce health resources, says Nicolaou. ‘Pharmaceuticals remains one of the most cost-effective interventions, whether it be at a preventative (vaccines) or treatment level.’

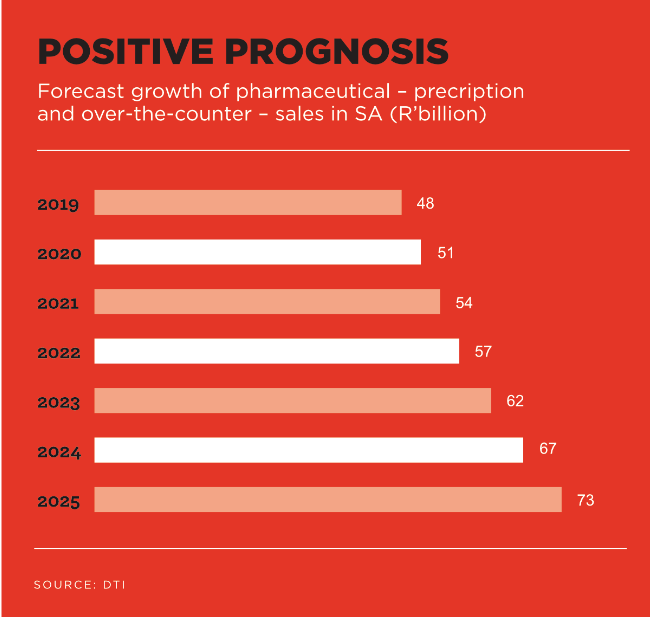

SA’s pharmaceutical sector is the largest and most advanced in sub-Saharan Africa. Pharmaceutical (and medical device) sales have more than doubled in the last 10 years and were expected to reach R48 billion and R19 billion respectively last year, according to the Department of Trade and Industry (dti).

In a fact sheet on investing in SA’s pharmaceutical and medical devices sector, the dti points to the country’s advanced manufacturing capabilities, including biotechnology manufacturing facilities, as well as strong R&D capabilities in the medical industry. It’s also the only SADC member country that meets the WHO’s Good Manufacturing Practice standards, according to the department.

This positions SA as a gateway to the Southern African market for manufacturers of pharmaceutical products. And it seems robust market growth is in the offing. The dti has forecast that pharmaceutical sales will increase by about 40% in SA over the next five years. This is partly driven by the rise in lifestyle-related diseases including obesity. hypertension, diabetes and cancer.

Aware of the industry’s enormous potential, the government has set up a strong framework of support, committing itself to creating a competitive environment in the sector, and focusing on programmes that promote and support domestic manufacturing and R&D. Due to policy-led preferences, low-cost generic drugs, which account for close to 40% of SA’s pharmaceutical market, have seen a rapid sales increase in recent years. Generics will remain the fastest-growing category, with sales rising twice as fast as those of patented drugs, says the dti. Generics are expected to overtake patented drug sales by 2027.

Support for R&D, meanwhile, is provided by the Strategic Health Innovation Partnerships. This collaboration between the South African Medical Research Council and the Department of Science and Technology funds and manages R&D projects for new drugs and medical devices, while the CSIR provides technical support (including testing facilities) to SMEs for the development of medical products.

To address regulatory red tape, the South African Health Products Regulatory Authority (SAHPRA), a recently established industry regulator, is mandated to accelerate product approval times and manufacturing-facilities certification. The government also established two industry clusters to improve the sector’s competitiveness and attractiveness.

Big pharma, which has a strong presence in SA, is seizing any and all opportunities. Of course, it’s not all just about rands and cents. Much has been written about ethical imperatives in helping to provide affordable and equitable healthcare for all, particularly in emerging countries. Dip into the annual reports of any of the major players and this will be borne out by their stated commitments and strategic pillars.

Aspen is an SA multinational company that has positioned itself as a differentiated supplier of quality, affordable medicines, underpinned by increasingly high-tech, efficient manufacturing capability. At establishment, however, it was a domestic-focused, largely generics business, says Nicolaou.

Two decades on, while it has maintained a broad-based SA presence, it has morphed into an organisation that is focused on a number of niche therapeutic areas, with highly differentiated specialty products, a global footprint and strong international networks. ‘This has necessitated a shift to sterile manufacturing capability, which presents a number of unique domestic and global opportunities,’ according to Nicolaou. Some of these niche therapeutic areas include leading global positions in anaesthetics, injectable anti-thrombosis products, high-potency products, and hormonal male and female healthcare.

‘While we’ve concentrated on Aspen’s high-tech, differentiated manufacturing capability, our business philosophy is very much focused on assisting healthcare professionals and patients solve medical problems. This can’t have been more aptly demonstrated than during the COVID crisis, where our anaesthetic and muscle-relaxant products are at the forefront of treating critically ill COVID patients on invasive ventilation in ICU.’

Aspen’s injectable antithrombotics also came into focus, as more and more severely ill COVID patients presented with clots and microemboli.

In a milestone in the battle against COVID, preliminary findings of Oxford University’s Dexamethasone trial showed encouraging preliminary results in COVID patients on ventilation, reducing mortality rates by 30% in these critically ill patients. Aspen owns the rights to Dexamethasone in a number of global markets, including SA. ‘This combination of products and others is an extraordinary contribution to the global fight against COVID by a South African company,’ says Nicolaou.

And this is not the first time that Aspen has found itself confronting pandemics. In 2003, it developed and manufactured Africa’s first generic antiretroviral drug.

When it comes to generics, a key SA player is Adcock Ingram, which manufactures and distributes generic medicines across a number of therapeutic areas and has been providing patients with access to quality and cost-effective medication for decades.

‘Over the years, the company has focused its efforts on broadening its existing generics portfolio,’ says Kavitha Singh, Adcock Ingram communications manager. ‘Our diverse portfolio of generic medicines provides treatment solutions for diseases that are of national health priority, with our leading generic antiretroviral, cardiovascular, pain and central nervous system portfolios providing the cornerstone of treatment for many patients.’

Singh adds that the demand for generic meds has peaked in recent months. ‘This has reaffirmed our commitment to ensuring that our leading generic-drug portfolio remains one of the most affordable in the market,’ she says. ‘We do this through ongoing engagement with medical schemes, public sector tender committees and our international supply partners, to ensure that we offer a diverse, relevant and sustainable portfolio of products.’

As the affordable-medicine landscape grows, the company’s focus will include specialised medicines as well as biosimilars. Generics are identical to the original in chemical composition, while biosimilar drugs are ‘highly similar’ yet close enough in duplication to accomplish the same therapeutic and clinical result.

Adcock Ingram recently received approval for its first biosimilar medicine – the first in a series of biosimilar medicines that it will bring to market through a partnership with South Korea-based Celltrion.

Pharma Dynamics is another influential player in the generics space and a leading cardiovascular products supplier. It was established as an SA business in 2001 and, in 2015, sold a 60% share to Lupin, a global pharmaceutical company based in India.

‘Our vision is to ensure effective, affordable medicine to all South Africans,’ says Erik Roos, CEO of Pharma Dynamics and the newly elected chairman of Generic and Biosimilar Medicines of Southern Africa. ‘It aims to do this via the strategy of identifying, registering and establishing these much-needed medicines at a decreased pricing strategy to ensure broader access.’

It’s not all smooth sailing though. ‘The company and the pharmaceutical industry at large have experienced dramatic product registration delays over the past five years, when compared to the average time taken by global standards,’ according to Roos.

However, with the establishment of SAHPRA, efficiencies are improving, and the industry remains hopeful and confident that much-needed medicines – originator, generics and over-the-counter products – will be registered at an accelerated or normal rate, benchmarking with international regulatory authorities, he says.

This will ensure that more products will be launched, and natural competitive dynamics between suppliers will evolve that will offer even broader availability of cost-effective medicine and treatments.

Of course, there are obstacles in the industry to overcome. Roos points, for example, to the impact of the depreciating rand on the cost of goods, as most active pharmaceutical ingredients are imported into SA and then locally packed. Still, the country’s pharmaceutical sector remains enormously dynamic and poised for growth.

The fall-out of COVID will be felt for years to come, and the sector, like many others, faces the disruptions of new technologies such as AI and blockchain, geopolitical shifts and other factors. But underneath this is all is a strong imperative to make medicines affordable for all. A simple, encouraging and empowering factor at its core.