Small businesses often find themselves between a rock and a hard place… They don’t have the required collateral or financial track record to qualify for funding from traditional banks but they can’t build up a track record because they don’t have the necessary funding.

Access to funding remains one of the main constraints for SMEs, restricting their growth and contributing to business failures. In SA between 70% and 80% of small businesses fail in the first year and around just half of the survivors last for the subsequent five years, according to the Department of Small Business Development. A report by the IFC puts the country’s SME finance gap – the difference between the available funding supply and the demand for funding – at more than $30 billion.

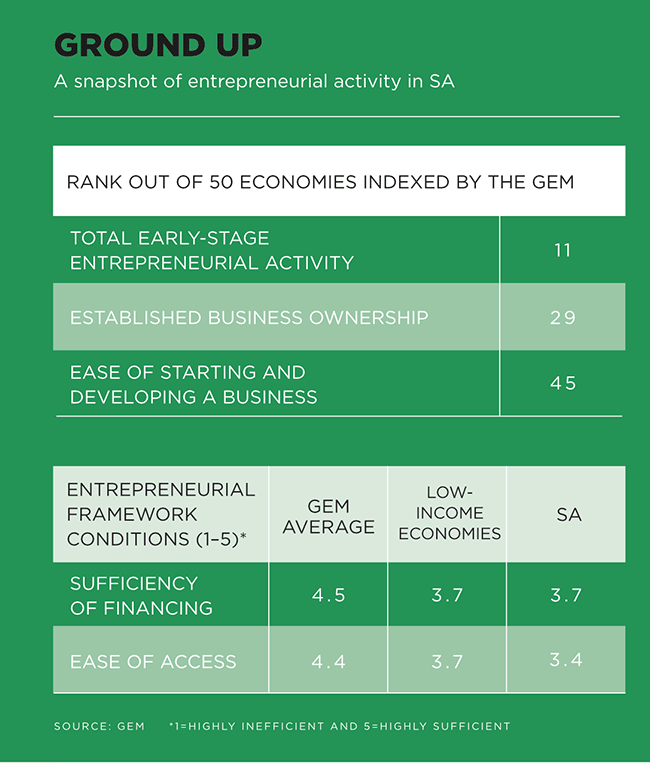

‘The qualifying criteria for business loans do not appear to have changed,’ notes the 2021/ 22 Global Entrepreneurship Monitor (GEM) South Africa, which was recently published by Stellenbosch University. ‘The financial-services sector at large needs to think more creatively about collateral, credit ratings and risk. For example, including criteria like how long small businesses have traded for and feedback from their customers, suppliers and creditors.’

Some of the big banks are acknowledging that small businesses have different requirements to large corporate clients, and are starting to apply a different credit lens when assessing their SME clients. They are also increasingly collaborating with fintech firms that address the funding challenge for SMEs.

One of these is ProfitShare Partners, which secured R100 million in funding from the SA SME Fund in 2020. The fund’s CEO, Ketso Gordhan, said at the time that ‘the availability of funding and access to working capital has always been a challenge for SMEs. This has been exacerbated by the country’s economic crisis, which has been deepened by the pandemic’. He highlighted his hopes for this alternative SME funding model to act as a catalyst for their survival and growth.

Andrew Maren, CEO of ProfitShare Partners, says that the large traditional banks initially saw his fintech start-up as a disrupter and competitor. ‘But now, five years later, the banks have come to realise that we are collaborators, because by developing and growing the SME market, we are actually helping them build their profitable clients of tomorrow.’ The fintech firm has established itself as an alternative funding provider for SMEs that already have a contract with a reputable company or government department, but are unable to access funding to deliver on this contract.

Potential clients can apply for capital support online without proof of security, financial history or track record.

‘We build up our clients to lose them, by assisting them to the point where they are either in a position to qualify for traditional finance or they no longer require finance,’ says Maren. He explains that the business model is a hybrid between venture capital and private equity, where instead of taking up shares in the SMEs, the fintech firm shares in the profit. ‘We only get paid when you get paid,’ he says.

The Doing Business in South Africa web-site, an initiative of the Department of Trade, Industry and Competition, sums up the situation. ‘Historically, SMEs have been an unattractive segment for traditional banks, so non-bank financial institutions have filled a much-needed gap.’ These institutions include insurance firms, venture capitalists and others that are not banks but provide banking services and often specialise in sectors or groups.

A recent example is Telkom Business, which in August 2022 announced the launch of its Telkom Lend platform for SME online funding applications. Eligible businesses will receive a money transfer within 24 hours after being approved, with Telkom saying that fast funding is a necessity so that businesses can be responsive to immediate opportunities instead of waiting for weeks.

The GEM report also notes that SMEs are increasingly benefiting from digital advancements in banking. ‘Together with non-bank financial services, the banks are rapidly implementing digital banking, creating both convenience and accessibility and driving the life cycle of their enterprise. Ideally, advice and funding should be packaged together.’

In line with this thinking, FNB has been offering free interactive entrepreneurial e-learning via its digital platform, where SMEs can access information that assists with incubation, starting, running and growing their enterprise.

Meanwhile Absa’s non-financial support is designed to provide SMEs with targeted interventions that are informed by the gaps identified in the bank’s diagnosis, according to Kgalaletso Tlhoaele, head of enterprise development at Absa.

‘This may include, but is not limited to, financial-management training, internal controls, marketing and sales management or operational efficiencies,’ he says. ‘We have a deliberate focus on assisting our SMEs to utilise digital enablers to optimise their time. This includes access to online business mentorship and coaching.’

The bank’s enterprise development division specifically takes into consideration the reality that SMEs don’t necessarily have a lengthy trading history or balance sheet to support the required lending. ‘We place greater reliance on the strength of the SME’s financial underlying contracts than current financial strength,’ says Tlhoaele. ‘This approach enables us to improve SMEs’ access to finance and broadens financial inclusion.’

SME support also means making life easier for this client segment – for example, through an integrated accounting tool that allows entrepreneurs to access real-time business analytics, produce online quotes and invoices, as well as access to a full payroll feature. ‘It makes it much easier for business owners to stay on top of their financials, even with limited accounting knowledge,’ says Thloaele. Then there is the newly launched Absa Mobile Pay, which enables merchants to use their Android smartphones as a point-of-sale device simply by downloading the app from the Google Play store.

It’s crucial that banks understand the specific financial situation of SMEs. Standard Bank gained insights through face-to-face client interviews, an online banking survey and direct business-banker feedback. These revealed that SMEs experience four pain points, namely hidden or unclear costs and costing structures of business loans; onerous in-branch approval and signing processes that take business operators away from running their businesses; loans that are slow to be approved, resulting in lost business opportunities; and inflexible repayment structures that make it challenging to honour loans.

In response, Standard Bank’s business innovation division, Moonshots, came up with ‘a digital, fixed-cost, pay-as-you-earn loan facility’. Called BizFlex, it offers loans at a fixed rand cost to help entrepreneurs know exactly how much their loan will cost them. Keldon Moodley, Moonshots’ head of BizFlex, gives the example of a client who borrows R100 000 and agrees to repay at 5% of revenue. Based on existing revenue data, the facility estimates a repayment term of six months, charging a fixed R10 000 for this loan.

‘Even if the client takes more than the six months initially estimated, [or the prime lending rate increases], they won’t pay a cent more,’ says Moodley.

When banks, fintech partners and other organisations find innovative ways to provide SMEs with funding solutions and support, they enable entrepreneurs to focus on their core business. That’s how SMEs can grow big and become the catalyst for job creation that SA so desperately needs.