As Eskom predicts load shedding to worsen and continue until at least 2027, mining companies are reaping the first rewards of their initiatives to self-generate reliable, affordable and cleaner power. In May 2022, Pan African Resources brought its 10 MW solar PV plant online in Evander, Mpumalanga – the first of this capacity to be commissioned by a mining company in SA, according to the miner. The local subsidiary of Juwi Renewable Energies (headquartered in Germany) constructed the approximately $10 million plant on rehabilitated land at the Elikhulu surface gold re-treatment facility.

‘We will operate this plant ourselves after a brief operations and maintenance contract with Juwi, during which our own employees are being trained to operate it,’ reports Pan African Resources. The solar plant generates about 30% of Elikhulu’s power requirements, saving R36 million a year in electricity bills and 26 000 tons in CO2 emissions, which, according to the company, also ‘enhances Pan African’s attractiveness to fund managers with a focus on sustainability’.

CEO Cobus Loots adds that ‘we will continue with energy independence and decarbonisation initiatives at all our operations, with another 20 MW of solar capacity scheduled to be constructed in the next two years’. This will include a 9 MW solar PV plant at its Barberton mine, also in Mpumalanga.

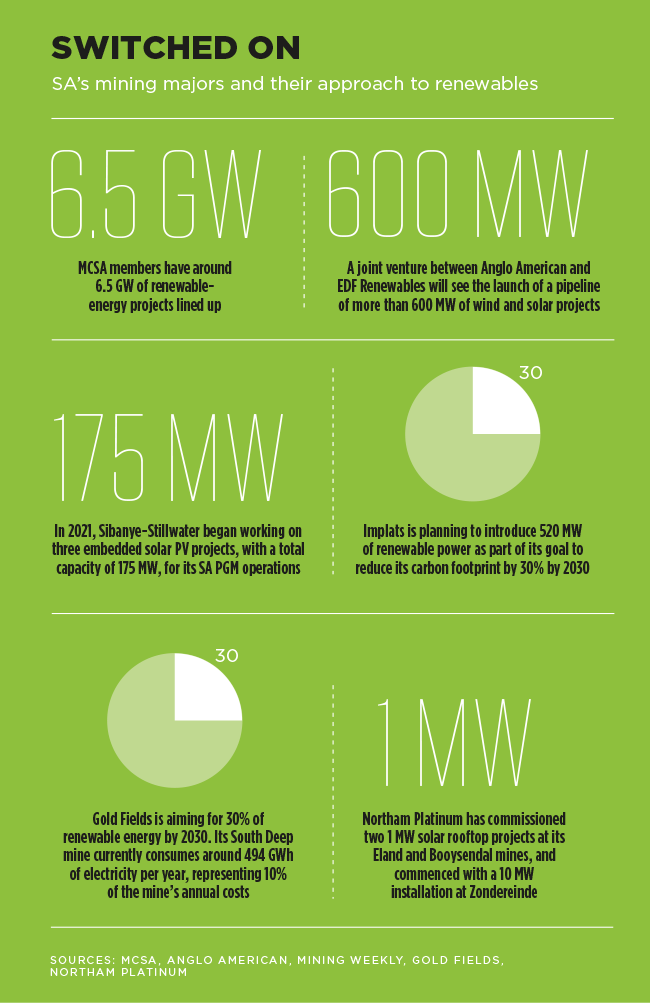

‘Most of our members are looking at setting up their own renewable-energy generation facilities,’ says Christian Teffo, technology analyst at the Minerals Council South Africa (MCSA). At present, member companies have 6 500 MW (6.5GW) in renewable-energy projects in different stages of planning and implementation. Of these megawatts, 100 MW were due to go live by the end of 2022, while 1 000 MW are set to become operational in 2023, with a further 2 000 MW in 2024.

The removal of the 100 MW cap on licence-free embedded energy projects by the SA government in July 2022 resulted in a wave of renewable-energy projects. The mining sector accounts for an impressive 80% of the 8.2 GW private-sector projects that are under way. More specifically, 29 mining companies have 89 embedded clean-energy projects worth more than R100 billion in the pipeline.

The current split of renewables in mining is 75% of solar projects versus 25% of wind, according to Teffo. ‘Solar has the advantage of being a renewable-energy solution across most of South Africa, while optimal wind conditions for wind farms are largely in the Eastern Cape, Western Cape and parts of the Northern Cape,’ says MCSA spokesperson Allan Seccombe. ‘So for mines that are inland, solar is the best option to generate renewable energy. This is evidenced by companies like Pan African at Evander and Gold Fields at South Deep building large solar arrays.

‘In addition, Eskom is making large tracts of land available in Mpumalanga for solar projects to easily access the state-owned company’s electricity infrastructure.’

However, while wind power resources in Mpumalanga may not be as good as in coastal areas, they are still sufficient to support a business case for wind energy, according to Enertrag SA. The renewable-energy company points out that government’s renewable-energy development zone in eMalahleni is restricted to the development of solar projects only, when it should also include wind to advance the just energy transition. At the same time, the constrained national energy grid and power lines urgently need to be expanded to fully unlock clean energy in the province.

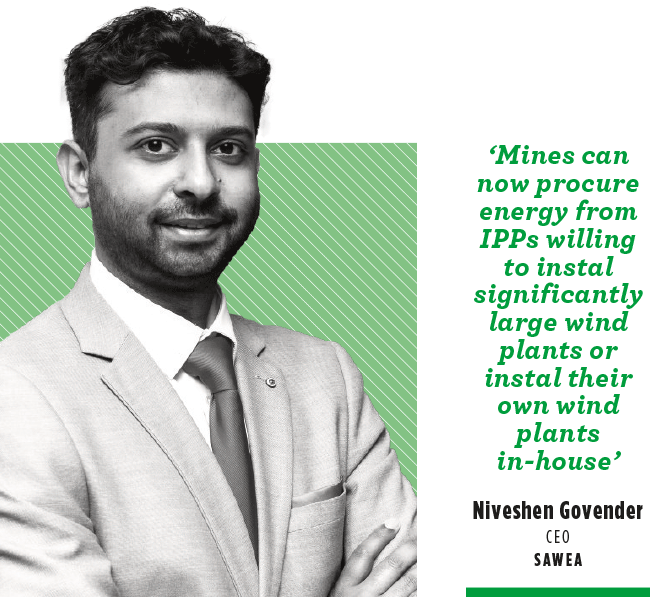

Niveshen Govender, CEO of the South African Wind Energy Association, explains that the removal of the generation licence cap has boosted private-sector interest in wind energy, where scale is crucial.

‘Mines can now procure energy from independent power producers [IPPs] willing to instal significantly large wind plants or instal their own wind plants in-house,’ he says. ‘While solar plants can be installed at a very small scale, a single industrial-size wind turbine is in the region of 2 MW per unit. Therefore wind farms require economies of scale to be financially feasible. A wind farm requires additional permitting for the transportation of abnormal loads such as the turbine blades, which can also require increased logistics costs.’

He adds that ‘the wind industry has been a part of the South African market for only the past decade; hence, the industry is still maturing, and we expect it to expand in line with the levels forecast in the Integrated Resource Plan’.

Renewable energy is the way forward for mining companies worldwide and especially in SA, where the precarious power supply provides added urgency to accelerate decarbonisation. Load shedding and curtailment, maintenance, capacity constraints and corruption at Eskom have huge cost implications for the mining industry by hampering production processes, damaging machinery and compromising worker safety.

‘The energy intensity of the mining industry, especially where mining companies have beneficiation operations like smelters or large processing plants, makes it one of the single-biggest catalysts for a real change,’ according to Sandra du Toit, energy and natural resources market leader at EY Africa. Du Toit, who led a recent panel discussion on the energy transition in mining, says one of the takeaways was that renewable energy is able to help mining companies manage their costs.

‘Self-generating, or concluding smart power purchase agreements with IPPs, can enable them to secure renewable energy at more predictable prices, and potentially with lower escalations over time. This will require clever partnerships, and sustainable agreements around the development and operation of renewable-energy projects.’

With electricity prices increasing sixfold in the past decade, power has become the second-largest cost component after salaries for deep-level and electricity-intensive mines, according to the MCSA. That explains why Gold Fields’ new 50 MW Khanyisa solar plant at South Deep (a mine that operates as far as 3 km below the surface) will save a massive R123 million in electricity costs a year.

Gold miner Harmony expects its ‘aggressive’ decarbonisation strategy to save more than R500 million in electricity per year. Phase 1 of the strategy will see three solar plants (with a total installed capacity of 30 MW) come online in the Free State in March 2023. Harmony developed the solar plants jointly with Energy Group (a specialist adviser and investor) and BBEnergy (an SA engineering company). In Phase 2, there are plans to build an additional 137 MW of renewable energy at several long-life mines.

To finance this phase, Harmony has taken on a syndicated loan facility led by Absa and Nedbank, which has been supported by various local and international banks and financial institutions. The multi-tranche loan includes a R1.5 billion green loan and three sustainability-linked loans (comprising a R2.5 billion revolving credit facility, a $300 million revolving credit facility, and a $100 million term loan).

Anglo American, meanwhile, teamed up with the SA subsidiary of French multinational EDF Renewables to form a joint venture. Called Envusa Energy, the new company will develop a regional renewable-energy ecosystem in SA and start by launching 600 MW of wind and solar projects. This energy-portfolio approach will wheel energy from geographically dispersed renewable-energy plants and allocate it optimally to meet the load demand for Anglo American’s sites. Furthermore, the roll-out of the renewable-energy ecosystem will serve as a clean-energy source for green hydrogen to power Anglo American’s zero-emission nuGen mine haul trucks – and thereby also support the development of SA’s Hydrogen Valley (which will extend from Limpopo through Gauteng to Durban).

In KwaZulu-Natal, mineral sands producer Richards Bay Minerals (RMB) – which is part of Rio Tinto – has signed a 20-year renewable-energy wheeling agreement with IPP Voltalia. The French-headquartered firm will build a 148 MW solar PV plant in Bolobedu, Limpopo, and start feeding power into the national grid by 2024 to supply RMB’s smelting and processing facilities in Richards Bay.

‘This project is the first of our South African large solar and wind portfolio under development, in areas with grid connection available, that will be ready to support our clients to overpass the actual energy crisis with affordable, clean and stable electricity,’ says Voltalia CEO Sébastien Clerc.

‘The Bolobedu plant will be our biggest project in Africa, after performing construction of a series of other solar plants for us or for clients in Zimbabwe, Burundi, Tanzania, Kenya, Mauritania and Egypt.’

In a similar deal, Tronox Minerals Sands entered a R4 billion power purchase agreement with the Sola Group, which reached financial close in September 2022. Sola is building two 100 MW solar plants in North West province to wheel electricity to five Tronox facilities in the Western Cape and KwaZulu-Natal. ‘It’s a great plus for the country that these projects are 100% South African-owned, financed, constructed, operated and managed,’ says Sola CEO Dom Wills.

‘We hope the model of private power through bilateral agreements continues to become more widely adopted. The benefits to the end-user are competition, choice and, ultimately, a more diverse contribution to the power system.’

These examples show that the SA mining industry is starting to benefit from the enormous opportunities in renewable energy. Now the country needs urgent investment in its national grid infrastructure to bridge the gap between energy demand and supply in a cleaner, more sustainable way. This would enable mining companies to not only future-proof their operations against load shedding and tariff increases, but – with the right combination of renewable-energy technologies – also extend the life of their mines and accelerate the low-carbon economy.