It’s tough out there for small businesses. Reflecting on the latest Experian Business Debt Index data, which measures the relative ability for businesses to pay their outstanding suppliers or creditors, Experian South Africa COO Thabo Hermanus says: ‘SMEs are struggling to sustain cash flows with which to survive in the face of tardiness on the part of their bigger counterparts to pay them for work done. It would seem that the brunt of the impact of the weakness of domestic economic conditions has been borne by small businesses, with many of these being forced to close down after struggling to remain in operation for as long as possible.’

SMEs are the proverbial canaries in SA’s economic coal mines. When the oxygen runs out, they’re usually the first to feel it. But while it has arguably never been tougher for SA’s small businesses, there has also never been a time of greater technological opportunity.

The 2018/19 SME Landscape Report, released by SME South Africa notes: ‘With the ever-changing nature of the technological landscape, small businesses are continuously adopting new ways of doing business. The decentralisation of technological services has enabled SMEs to access new markets, reduce business costs and increase efficiency.’

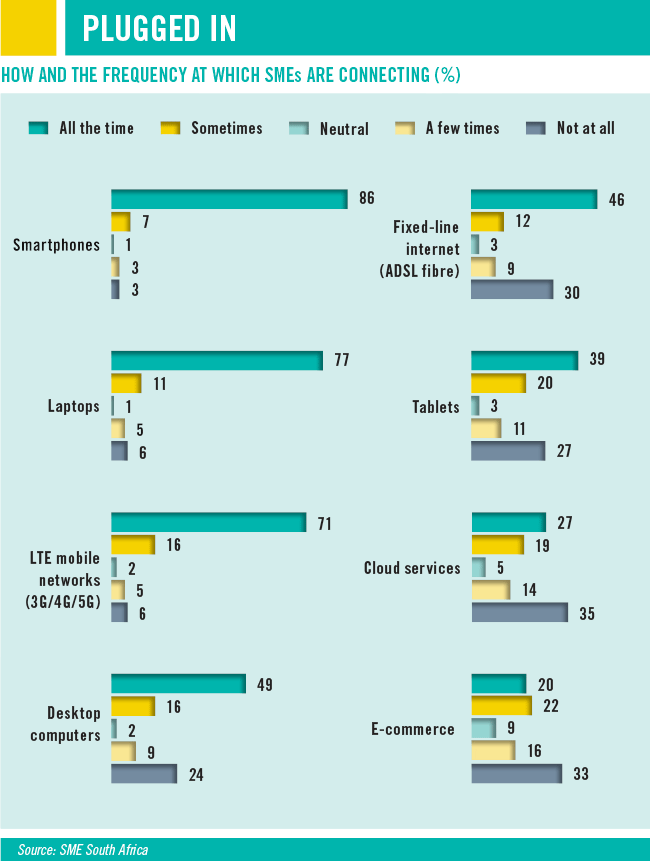

The report surveyed 1 157 SA SME owners, and found that the majority (86%) use smartphones in their business ‘all the time’. So far, so encouraging from a tech perspective. But when asked about other tech tools, only 27% of respondents said they use cloud services on a regular basis, while just 20% regularly use e-commerce.

That finding was underlined by the exact 50/50 split between SME owners who were asked whether technological limitations pose an obstacle to growing their business. Of those who said it did, 60% cited stable and reliable internet access as the main obstacle.

Those findings point to gaps in infrastructure and skills development, and they’re especially interesting when seen against the backdrop of the dawning, much talked-about Fourth Industrial Revolution (4IR). As the SME Landscape Report highlights, 4IR is ‘disrupting the way business is done across sectors while creating opportunities for businesses. It is important for SMEs to use technology to better position themselves to take advantage of opportunities for growth when presented’. Encouragingly, only 7% of survey respondents said they were ‘not ready at all’ for technological disruption. The rest, mostly, were raring to go.

How can SME owners harness those digital technologies? Viresh Harduth, VP: new customer acquisitions (small and start-up business) at Sage Africa and Middle East, believes that they should learn how to capture, process and analyse their business’ data. ‘It might sound daunting, but data analytics is no longer just for data scientists,’ he writes in a blog post. ‘Modern analytic solutions have been designed with business users in mind, to make it easy for anyone to experiment with data and create useful visual reports. ‘For example, knowing exactly when customers enter your sales funnel, from what sources, and when they drop off and no longer engage with you, is invaluable when planning your communication and engagement strategies.’

Harduth adds that by capturing and analysing customer data, SME owners can ‘build a solid database that makes email and direct marketing a breeze’.

That’s a significant boost in an environment where, according to the SME Landscape Report, only 13% of SA’s SMEs employ more than five people. When your only employee is you (as is the case for 39% of SMEs), you have to function as your business’ CEO and head of marketing, along with everything else in between. This is where enabling technologies become key to the survival of small businesses.

Colin Timmis, general country manager at accounting software provider Xero SA, likens a business to a human body. ‘There are systems that need to work together for it to accomplish what it needs to on a daily basis,’ he writes. ‘And these systems need to be maintained.’

Timmis adds that the core is one of the most important systems of all. ‘It stabilises the body, allows you to build strength in other areas and, crucially, ensures you have the right balance. When it comes to your business, you need to give serious consideration to its core systems – and your financial systems are easily your most important. You need robust financial management, a solid business plan, and a clear strategy for future growth, among other things. Focus on this and your company will become stronger; neglect it and it will become weaker,’ he writes.

Fortunately, the new digital world of work allows small businesses to build solid foundations by using relevant technologies. Timmis lists AI, automation and app integration among the solutions, and while those may seem beyond the reach of many SMEs, his other suggestion – cloud computing – is not.

‘Chances are you’re using it already,’ he writes. ‘Gmail and Dropbox would be typical examples of cloud technology: they can be accessed from anywhere, at any time, from a variety of devices – opening up access to your messages and your files as long as you have an internet connection (or simply work “offline” if your internet is down). With some software tools, you can reconcile receipts with bank statements in minutes – from anywhere in the world. This means tasks that used to take hours can be done almost instantly. Accountants and business owners can also benefit from greater collaboration, remote access to data, enhanced responsiveness, and better cash-flow management.’

These solutions allow SMEs to feel and function like a bigger business – whether they’re a four-person or even a one-person show. They also allow enterprise solutions to be implemented in businesses that are far from being large corporates.

‘Quality video conferencing, together with the added features of presence, document sharing, screen sharing and mobility capability, also known as unified communication [UC], has typically been considered the domain of large corporates that can afford the associated high cost,’ says Corrie Lynch, ICT delivery DSM expert: connectivity services at T-Systems South Africa. ‘However, smaller businesses had to “make do” with inefficient, low-quality and usually insecure platforms. Fortunately, this is changing, providing these smaller businesses with access to enterprise quality solutions.’

As Lynch explains, smaller, more agile businesses often need these tools just as much – if not more – than larger operations, as they tend to leverage a more mobile workforce. ‘Without the right tools, collaboration and effective communication becomes difficult,’ he says, leaving SMEs to resort to free or cheap platforms that aren’t as secure or reliable, and don’t offer any technical support.

‘The cloud has opened the opportunity for SMEs to make use of corporate-grade UC solutions without having to buy the solution or subscribe to a set number of licences,’ says Lynch. ‘These tools can be provisioned over the hardware that the business already has, or bundled together with the required hardware, handsets and video equipment. The services also extend to mobile users, allowing for the same tools to be accessed on a user’s mobile device, from any internet connection. This allows SMEs – or businesses of any size, really – to make voice and video calls over their data connection, saving on expensive mobile tariffs.’

Given that 71% of SA SMEs generate an annual turnover of less than R200 000, with only 20% generating between R200 000 and R1 million, cost savings are critical. As cash-flow challenges continue to kill off small businesses, and access to capital remains as elusive as ever, the country’s SMEs need all the levellers they can get to remain competitive. Technology – now more than ever – is that leveller.