One of the top stories of 2019 is the Euronext Amsterdam primary listing in September of Naspers’ global consumer internet company, Prosus NV, with a secondary listing on the JSE. It is also Computershare SA’s most complex transaction of the year. Naspers is undoubtedly one of the JSE’s top performers; its value growing to R1.5 trillion from R2 billion shortly after the turn of the century.

THAT’S A BIG DEAL

There is certainly no better example of a bigger deal than the Prosus listing, and Computershare SA’s issuer services team was specifically selected to manage it due to its depth of experience and ability to move shares cross-border into Europe.

A corporate action – regardless of type, size or jurisdiction – comes with great pressure on issuers to complete transactions on time with the least cost, risk and impediments, while still deriving real value from the transaction. Seasoned business journalist Tim Cohen put things into perspective when he reported that Naspers is larger than Anglo American, Standard Bank, FNB, Vodacom and MTN combined. ‘Given the size, the importance of this listing can’t be understated for South African shareholders.’ This is where Computershare SA’s 21-year-long legacy of customer focus and versatility comes in.

LOCAL EXPERTISE BACKED BY GLOBAL RESOURCES

Within today’s complex and uncertain global market, organisations face increasing pressure to improve the efficiency and effectiveness of their relationships with their stakeholders, including shareholders and employees. To be successful, issuers need access to world-class services that unlock value and remove the many barriers to attracting, retaining and servicing these stakeholders. In Computershare, they will find a service partner that can help them navigate regulatory and capital market structures with the flexibility required to meet shifting business needs.

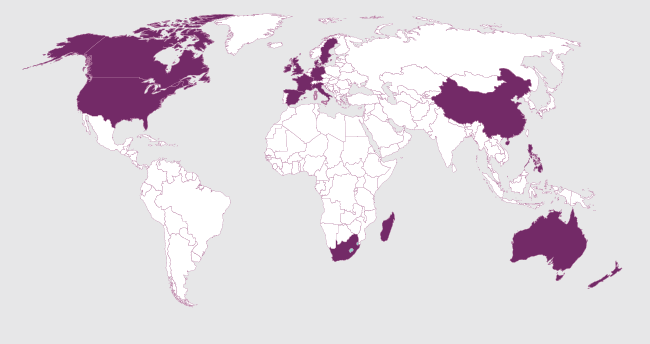

Computershare’s global reach extends to 21 countries, with more than 71 million shareholder accounts across the world. Consequently, it provides clients with access to local and global experts who have a wealth of knowledge derived from working with their own clients – listed and unlisted– and shareholders in differing environments. This provides issuers with the certainty, ingenuity and advantage of maximising the value of their relationships.

A PARTNER IN NAVIGATING THE DIGITAL EVOLUTION

The ability to connect issuers with their shareholders through effective digital communication is crucial when providing administration services, yet more so when they realise benefits of understanding shareholder voting trends, and increasing shareholder access and investor education.

With its holistic approach, Computershare partners with clients as their issuer agent to take a strategic view of an issuer’s diverse set of needs and develop a portfolio of integrated value-adding solutions that seek to create further efficiencies and reduce costs for issuers, whether they are listed or unlisted companies. Its big data insights provide clients with improved reporting and expanded investor analysis. The application of its robotic process automation generates efficiencies that translate into a greater issuer and shareholder experience.

Computershare is the administrator of choice in nominee structures and employee share plans, and its long-established online tools, enhanced contact centre and communication capabilities allow its clients to maximise the value and long-term loyalty of their own stakeholder relationships. To attract and retain quality staff, a well-structured and managed employee share plan can significantly improve employee retention rates by driving value, loyalty and ownership in the relationship, making it more attractive for employees to remain for the long term. Computershare is at the forefront of employee and executive share-plan solutions, working closely with companies to create the right share-plan approach to meet their needs, complemented by an array of compliance reporting, all while contributing to investor education and financial inclusion in SA.

Instant access to information is critical to successful stakeholder servicing, which is why Computershare provides its clients with online self-service capabilities that offer convenient access to a suite of standard, customised and query-based reports. Investors and employee-plan participants benefit from direct access to an array of intuitive reporting, enquiry, update, self-service features and online deal routing.

As the regulatory and corporate governance burden increases, data integrity and compliance with local and global regulations become vital to a company’s continued growth and success in the marketplace. Computershare’s governance services have the ability to significantly reduce that burden, helping companies manage critical corporate data and comply with legal and regulatory agencies. Computershare’s operational and technology strength also translates into capabilities that cater for a diverse range of business process outsourcing requirements.

IMPROVING THE ISSUER AND SHAREHOLDER EXPERIENCE

On a much larger scale, Computershare globally is engaged in piloting powerful innovations; many now live in production. For the past 18 months, Computershare SA’s innovation pipeline has been gearing towards upgrading existing channels and providing greater shareholder access to smart technology. New innovations coming to the fore enhance the issuer and shareholder experience.

The solid progression of Computershare SA’s success locally is the way it serves its clients, which for years have included retail investors. Computershare SA has more than two decades of experience as a CSD participant; and the company believes in fiercely championing greater shareholder access, financial inclusion, financial literacy and creating a culture of saving and investment for the broader community. It has developed unique BEE schemes and, being exchange-neutral, works with SA bourses to launch distinctive solutions that create simpler, quicker and more cost-effective methods for transacting investors’ assets.

Whether looking to improve efficiencies in managing their stakeholder base, or recognise and reward their employees, clients can draw on Computershare’s world of experience, whenever and wherever they need it.