This year has once again seen global capital-scouring markets around the planet in search of returns, and one of the destinations that has excited interest is Africa, with its emerging debt capital markets. Debt capital or non-sovereign local currency denominated bonds are a relatively new instrument on the continent, outside of SA. And while macro-economic conditions in some locales have created challenges, there have been encouraging signs of both innovation and resilience in this space.

Zoya Sisulu, Standard Bank head of debt primary markets South Africa, points out that ‘the commodity cycle is far from favourable’ and that this has had a particularly heavy impact on the fiscal conditions in the continent’s major oil-exporting countries, Nigeria and Angola. She adds that political stability has been problematic in some African countries and that there have been other structural concerns, such as the issues facing Kenyan banks. Three banks were placed under regulatory supervision last year.

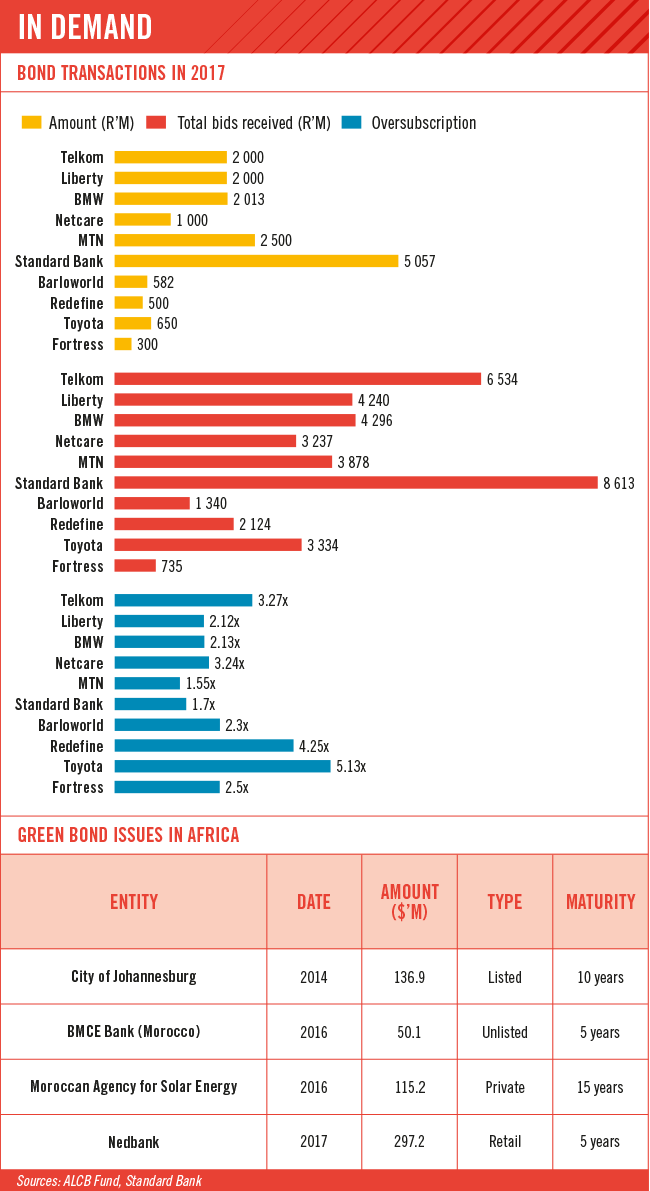

Nevertheless, says Sisulu, there has still been encouraging corporate bond activity across the region. This has been most marked in SA. According to Sisulu, this year local bond issues have been strongly oversubscribed. Of the 11 corporate bonds where Standard Bank has been the arranger in 2017, all were oversubscribed.

The extent to which capital was queueing to get into these instruments is demonstrated by the fact that the most popular bond, Toyota’s three- and five-year R650 million issuance, was 5.13 times oversubscribed. Growthpoint’s R800 million issuance was 4.4 times oversubscribed, Redefine’s R500 million bond 4.25 times and Netcare’s R1 billion bond 3.24 times. Even the ‘least popular’, Standard Bank’s R5 billion bond was 1.7 times oversubscribed.

By the end of August, some R51.8 billion in foreign capital had poured into SA’s bond markets, according to Overberg Asset Management. The SA bond market is of course older and more developed than those in most African countries. Corneleo Keevy, Ashburton Investments head of credit risk management, points out that SA makes up about half the value of Africa’s $300 billion debt capital debt markets. SA issued its first corporate bonds in 1992 and by 2017 had issued in excess of 1 500 corporate debt instruments. In fact, says Keevy, SA’s value – added to the bigger markets of Egypt, Morocco, Nigeria and Kenya – accounts for 90% of the continental market. He argues that the big driver in the SA market since late 2016 has been the need for investors to deploy cash. Local currency denominated debt capital is a subcategory of the wider capital market. Strictly speaking, capital markets include not only bonds but also other equity market transactions, such as initial public offerings and further capital offerings.

Andrew Del Boccio, practice leader at PwC in Johannesburg, says that Africa’s potential for capital-market growth is largely untapped. ‘The continent is home to about 700 companies with annual revenues in excess of $500 million, only 40% of which maintain a listing,’ he says. ‘Entry by these participants will deepen and widen the African capital markets landscape.’

Sisulu is of the opinion that debt capital markets develop through four sequential stages. The first user in most countries is government – after that, she adds, the sequence is government-owned entities (such as utilities), followed by the big financial institutions (banks) and finally the corporates. ‘When local corporates regularly issue commercial paper, then the market can be regarded as having achieved a degree of maturity,’ she says.

With corporate bond issuances representing the holy grail of capital market development, Keevy’s observation that these account for ‘only 5% to 10% of issuances in Africa, outside of South Africa’ shows there is room to grow. But, as Keevy points out, there is a structural impediment here. ‘Government paper, in the form of one-year Treasury bonds [T-bonds] offers such high rates of interest in sub-Saharan Africa that the private sector is effectively squeezed out. In Nigeria, the rate is about 20%, while in Ghana and Zambia it is about 15%.’

In fact, between January and August 2017, the average yield on the Nigerian government’s 364-day T-bond was 22.91%. ‘Because government is paying so much, it doesn’t make sense for corporates to issue paper and rather rely on funding from local or international banks,’ says Keevy. By contrast, SA’s 364-day Treasury bill was being offered at 6.85% at the Reserve Bank’s weekly auction in early October.

Del Broccio explains what has happened in Nigeria. ‘The decline in revenues, especially from oil, has severely impacted the Nigerian government’s budgetary obligations. This has led to a widening of the deficit from 1.6% of GDP in 2015 to 2.2% in 2016.’ He adds that ‘to finance this deficit – the highest in seven years – the Nigerian government issued bonds to the value of some 2.2 trillion, the highest domestic borrowing in recent years’. This drove yields up to a point where corporate bonds simply could not compete by comparison.

Multilateral development finance institutions are playing a major role in attempting to deepen Africa’s credit markets. The AfDB launched the African Bond Index (ABI) in 2008 as one of the two legs of its African Financial Markets Initiative (AFMI). The AfDB noted at the time that ‘bond markets in Africa remain largely underdeveloped, with corporate bond markets non-existent or in their infancy’. The AfDB has subsequently played a catalytic role in their development.

Keevy comments that information is a crucial part of this. ‘It is critical for markets to develop a yield curve that shows interest rates across different contract lengths. In developed markets, yield curves are well developed for different types of instruments over time.’ In developing markets, with so much less depth and diversification, yield curves are limited, providing little transparency in terms of pricing risk for different instruments, he says.

The AfDB’s ABI initially covered only the six most developed markets on the continent – SA, Egypt, Nigeria, Kenya, Botswana and Namibia. In 2017, it added two more – Ghana and Zambia. The AfDB is, however, doing more than simply tracking the figures. It has just started to play in the markets too. The second leg of the AFMI is an investment fund, the African Domestic Bond Fund, dedicated to investing in the continent’s bond markets. Keevy says the $25 million initial seed funding is not, on its own, going to change the world. However, in his opinion, ‘the objective is to crowd other investors into the markets’.

According to Keevy, Kenya has one of the most developed bond markets in sub-Saharan Africa outside of SA. ‘They’ve gone further than most African bond markets and managed to diversify. They have developed a yield curve that means something,’ he says. He adds, however, that corporate issuances in Kenya are still only a small portion of the market, ‘somewhere between five and 10%’. In fact, East African Breweries $58.5 million issuance this year was the first since 2015.

The Kenyan market is notable for innovation. It was the first in Africa to host bids for infrastructure bonds, issued by the central bank since 2009. These are effectively government (Treasury) bonds used to finance infrastructure, rather than dedicated project bonds. Although they are used to finance a list of identified projects, they are not tied to returns on those projects such as the bonds raised in SA to finance renewable energy generation.

This year, Kenya began retailing a bond that could be purchased by mobile phone. The bond, named M-Akiba (‘akiba’ meaning ‘savings’ in Swahili) is worth $48 million and can be purchased in small amounts (as little as $30) by members of the public. Kenya has yet to issue green bonds, a relatively new instrument designed to finance environmentally friendly projects. These seem to be the next major innovation in the debt capital space.

Internationally, green bonds issued so far have a total value of $696 billion, says Angela Mokone, a debt markets transactor at Rand Merchant Bank. According to Keevy, these have had only limited exposure in Africa so far, with two local currency instruments being issued in Morocco and three in SA. The most recent SA issue was a R1 billion bond by the City of Cape Town earlier this year. Keevy notes that green bonds come with ‘an additional level of oversight that can be quite onerous and costly for issuers’. They need to be certified in terms of the Climate Bonds Standard, and set and managed by the Climate Disclosure Standards Board and its secretariat. To achieve this, projects have to go a long way down the line before looking for finance.

In Cape Town’s case, the projects identified are mostly in the water sector – many of them focused on demand management. Mokone says the capital raised will also be spent on electric busses and plants to recycle sewerage water. According to Mokone, the bond, worth R1 billion, was nearly five times oversubscribed. At a coupon of 10.17, the 10-year bond was clearly attractively priced.

In her view, the event uncovered a healthy appetite for green finance among SA financial institutions, and there are likely to be more issuances in the green space in future. She says the JSE is planning to launch a green segment in response to this demand. It is quite likely to include the other two green bonds issued in the country: the City of Johannesburg’s R1.46 billion 2014 issuance and the International Finance Corporation’s R1 billion 2015 issuance.

Sisulu sums up the window of opportunity in Africa. ‘The markets are very supportive at the moment and there is a lot of positive sentiment around the world for emerging market assets.’ She adds that oversubscription to bonds issued in 2017 should be seen as a positive factor, showing a level of demand that can be built on.