M&As are notoriously complex. Recent significant changes in the corporate and legal landscapes have only made them more so – underlining the point of how essential good advice is when businesses venture into the M&A domain.

These are multiple arenas indeed. Deal Room’s recent global report on the current state of M&A notes how ‘M&A was a haven for corporate activity during the coronavirus pandemic, leading some to believe that almost nothing could stop dealmaking momentum’. DealRoom was right, of course – globally, 2021 smashed all transaction records, breaching the $5 trillion mark for the first time in history. But as COVID-19 cleared, masks came off, busi nesses went back to the office, and dealmakers hit the doldrums.

‘Data provided by Bloomberg indicates that at $1.3 trillion deal volume in H1/23 was the second-lowest in nominal terms over the past decade,’ DealRoom’s report states.

‘And when the recent high levels of inflation are factored in, it’s likely we have witnessed the worst first half of a year for dealmaking since the global financial crisis and its immediate aftermath. But at least we could console ourselves that balance sheets weren’t as healthy back then.’

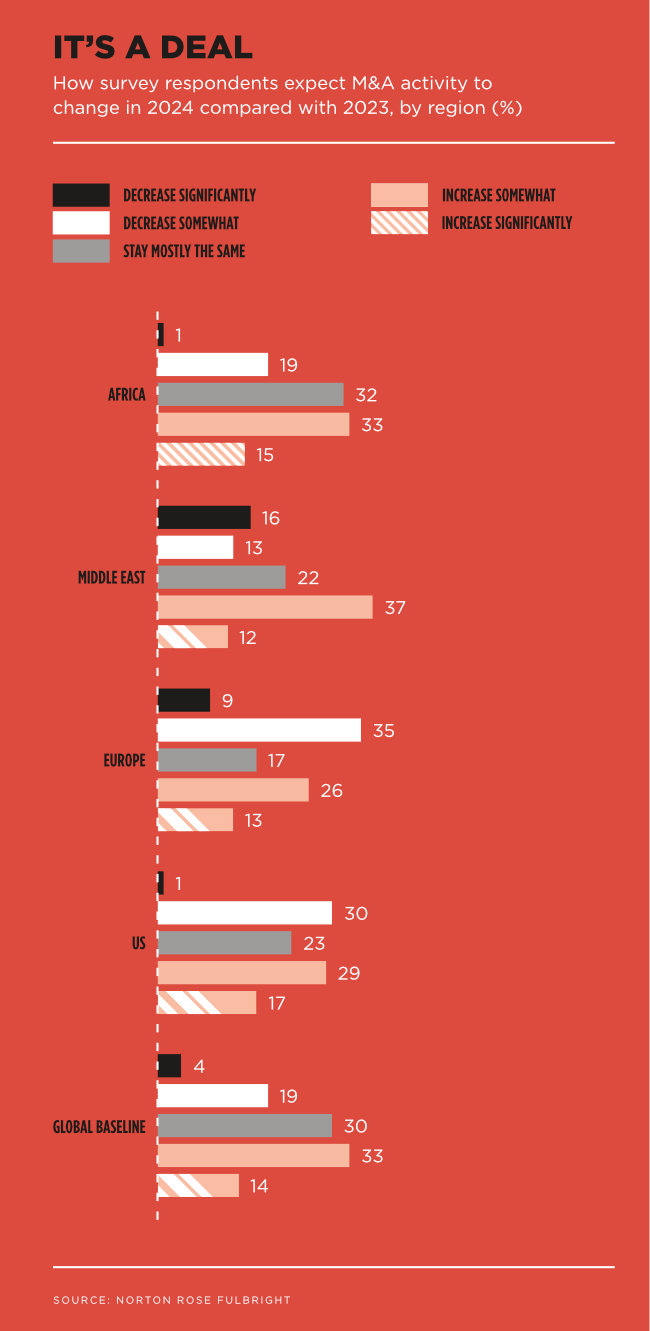

This year has brought a renewed wave of optimism. ‘The M&A market is entering a new phase in 2024 that will differ from prior ones,’ according to Brian Levy, global deals industries leader at PwC United States, in a recent outlook report.

‘The upturn will almost certainly be more measured than the surge of dealmaking activity that occurred during late 2020 and in the record-breaking year of 2021. Dealmakers will be facing very different conditions in 2024 to the past few years and will need to adapt their playbooks accordingly.

‘For example, although credit markets have reopened, financing is more expensive than it has been for a decade. The higher cost of capital will put downward pressure on valuations and require dealmakers to create more value to deliver the same return as before.’

Levy adds that as the wider global macro-economic and geopolitical landscape remains uncertain, dealmakers who can assess risks and plan for different scenarios will be more confident in taking action than those who may be waiting for greater clarity to arrive.

‘The mood for M&A dealmaking in 2023 was subdued, and the outlook for 2024 is hard to predict,’ says David Pinnock, director in the corporate and commercial practice at Cliffe Dekker Hofmeyr. ‘We are cautiously optimistic about an uptick in M&A activity, amid the continuing economic and geopolitical uncertainty of this post-pandemic era.’

Many multinational companies consider SA a safe entry point to the rest of Africa. ‘International investors still regard South Africa as a gateway into the continent,’ says Stephen Kennedy-Good, Norton Rose Fulbright’s head of corporate, M&A and securities in SA, in the firm’s Global M&A Trends and Risks 2024 report. ‘It is an investor-friendly destination with numerous protections for foreign investors, including a sophisticated constitution and independent courts. South Africa’s developed financial services sector remains a keen attraction for foreign companies. While foreign investment activity has slowed down, international corporates and [private equity] funds continue to look for opportunities.’

While many multinational companies see SA as a safe entry point to the rest of Africa, the expected spike in SA cross-border M&A deals hasn’t happened – yet. Andile Nikani is executive director of the Takeover Regulation Panel, SA’s independent M&A regulator, which reports to the Minister of the Department of Trade, Industry and Competition. In a recent interview with Harvard International Review, he spoke about how the industry had expected an increase in cross-border M&As, partly because the share prices of so many major SA companies were depressed. But, he said, ‘that didn’t happen – not to the degree that we expected. So I suppose that’s great, if you like, because every country likes having its own national champions and you don’t want your national champions being acquired by foreign companies. That is certainly not something that we dream about, but it’s not something that we can prevent either because commerce is commerce and these are open markets, and people are free to buy and sell as they wish’.

So, Nikani told the publication, the deals in SA are ‘less cross-border [and] more local companies that are buying each other. Alternatively, companies themselves are buying back their own stock for the purpose of delisting themselves from stock exchanges in South Africa. So those are the vast majority of transactions taking place in that space’.

However, significant shifts in the regulatory landscape continue to make even local dealmaking a tricky business.

‘Deal timelines – that’s the period between agreeing the terms of a transaction and the closing of the transaction – are becoming more and more extended as the regulatory frameworks for consummating a deal become increasingly complex,’ says Pinnock. And as that trend continues, it will pose considerable challenges for dealmakers, including the difficulties of agreeing on a valuation on a target where the deal can only be finalised several months – or even years – later.

‘Such long interim periods naturally increase the risks attendant on the valuation of a transaction, and require an increasingly flexible approach to managing those risks through innovative but complex valuation mechanisms, price adjustments and interim period protections,’ he says. ‘Naturally, while buyers are seeking flexibility – including walk-away rights – sellers want to ensure that the deal in hand is locked in. The need to balance these interests and to “legislate for the future” is a feature of modern South African M&A.’

Added to that, the increased uncertainty as to when and whether a deal will be closed creates obvious barriers to concluding a deal in the first place. ‘A buyer has to take into account not only what a target business will be worth at some unknown future date, but also whether it is prepared to undertake a long, expensive and public process; whether its funding for the deal can be extended, and at what cost, along with myriad other complexities,’ according to Pinnock. ‘Public interest considerations imposed by regulatory processes, which tend to emerge only after a deal is agreed, also add unexpected costs.’

Local M&A deals must abide by local M&A laws, and here the past couple of years have seen significant shifts in the regulatory landscape. Many of these regulatory changes were enacted in late 2022 as SA tried (unsuccessfully, it turned out) to avoid being grey listed by the Financial Action Task Force.

One of the amendments to the Companies Act included a requirement to file beneficial shareholder disclosures with the Companies and Intellectual Property Commission (instead of just notifying the Takeover Regulation Panel) and to update the list whenever share capital within a class of shares changes by 5%.

However, as Norton Rose Fulbright’s report highlights, the focus on merger approvals in SA continues to be on issues of public interest. ‘The South African competition authorities are increasingly imposing conditions on transactions to ensure local ownership, including through employee share ownership plans and to see the betterment of local South African black ownership,’ it states. ‘Having said that, the recently issued competition law exemptions, for example in the energy sector (which allows firms to co-ordinate conduct in certain circumstances which our laws do not otherwise allow), have opened the doors for new business opportunities and created space, especially for some international players, to combine efforts with local firms.’

Minister of Trade, Industry and Competition Ebrahim Patel is already reporting the benefits of this increased application of public interest criteria in the consideration of M&A deals. Speaking at the Competition Commission’s annual law, economics and policy conference in September 2023, Patel said that a limited study by his department found R67 billion in new investment flowing into the economy and 236 000 saved jobs in the past five years as a result of the policy. Meanwhile, he said, 22 000 jobs had been created during the same period through this policy, based on a review of 30 competition settlements.

Those public interest conditions may be for the public good, but they add another layer of legal complexity to the already tricky M&A world. Add to that the difficulties that come with (largely unregulated) cross-border deals, as well as the intricacies of the domestic and global operating environments, and you’re left with a space where dealmakers need to tread carefully… And one where lawyers really do earn their fees.