Simply being ‘less bad’ does not cut it anymore. Where in the past the focus of global business was on creating shareholder value and profits that required trade-offs at the expense of the environment and society, it’s no longer acceptable that companies, for example, offset heavy emissions by buying carbon credits rather than trying to reduce them, or ignore labour issues such as the executive payment gap or living wages. Faced with material risks relating to ESG issues and the climate crisis, today’s companies are being held accountable for the impact of their operations, to the extent that in SA directors can be criminally prosecuted – and jailed – for corporate ESG transgressions.

Companies are therefore increasingly expected to report on their ESG impacts, risks and opportunities with the same rigour that they apply to their financial reporting. In fact, sustainability reporting will soon be mandated for a wide spectrum of companies by regulators in most countries, according to Mervyn King, father of the King Report on Corporate Governance and founder of the Good Governance Academy at Wits Business School.

However, he explains that unlike most compliance requirements, mandatory sustainability reporting typically involves the publication of information that has never been tracked nor used by the organisation before – providing ‘a hive of new opportunities’ for corporates.

As ESG has moved from niche to mainstream globally, there is still much confusion around how to define and apply it. Often used as a synonym for sustainability, the three letters stand for a way of breaking down and organising key sustainability issues, as a basis for establishing frameworks and standards that can assist companies in the quest for sustainability. SA’s corporate leaders in sustainability now aim to be regenerative. They’ve long gone beyond compliance and zero harm, towards embedding ESG strategic intent in their business to create shared value for people, planet and prosperity.

‘The pursuit of profit the way we’ve done it, up to now, has in many instances contributed to the social inequalities and the environmental degradation, despite the fact our long-term survival depends on a stable society and environment,’ says Shameela Soobramoney, Chief Sustainability Officer at the JSE.

‘No business is going to prosper in a society and environment that are failing. We must therefore change this trajectory, here and now, to meet the needs of society in a manner that is efficient and equitable within the context of our planetary boundaries.’

To achieve this, business leaders are urged (by the Globally Responsible Leadership Initiative) to take three laws to heart.

Firstly, the natural system is not a stakeholder in the businesses; it is the ultimate foundation of the rules. Secondly, everything, everywhere is linked in a single system; therefore, every action must be considered in the context of its effect on the whole system. And thirdly, globally responsible leaders must become engaged in solving the dilemmas that confront us as a consequence of the first two laws.

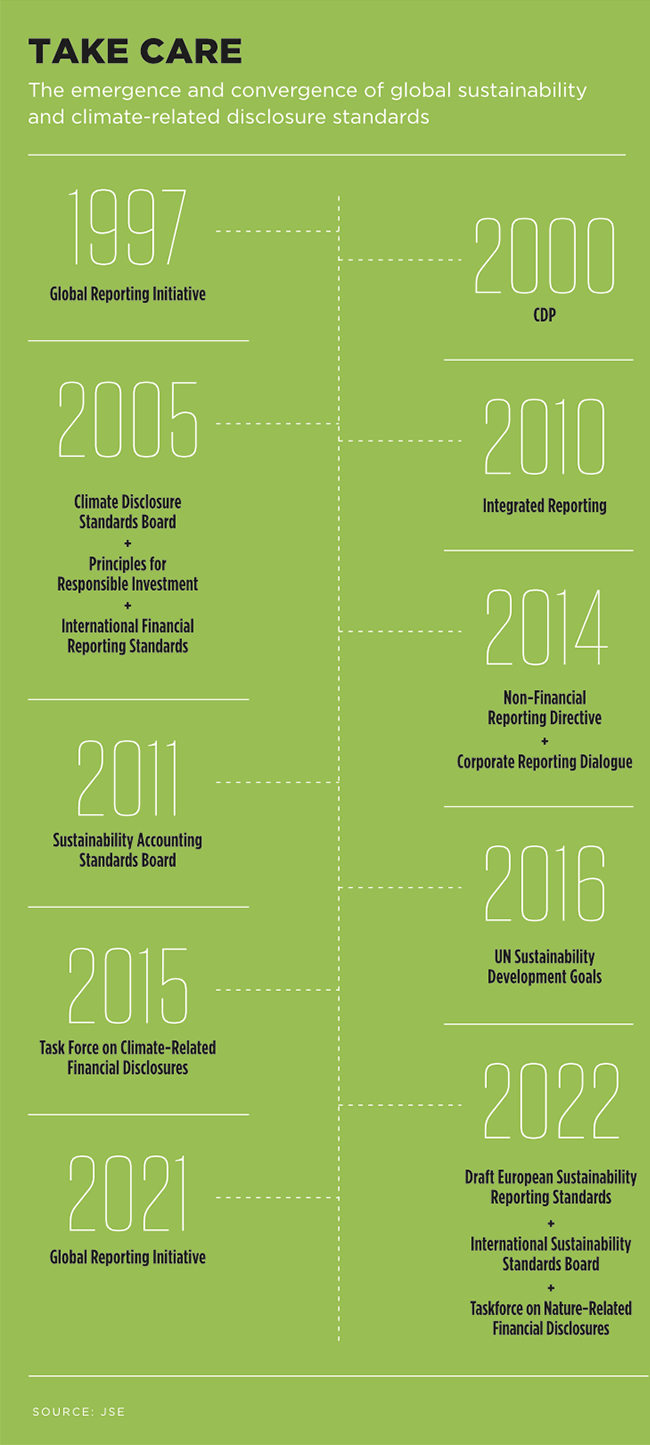

However, where to start? The JSE published a voluntary Sustainability Disclosure Guidance to help companies navigate the sustainability landscape and make sense of the global ESG reporting frameworks and standards with their bewildering acronyms. Launched in June 2022, it’s a guide on how to think about (and report on) sustainability issues in an integrated way. Soobramoney describes the document – which is not a listings requirement and was developed after extensive stakeholder consultation – as user-friendly, readable and easy to access for anybody from junior level to C-suite decision-makers. Tailor-made for the SA context while aligning with the global landscape, it’s a quick entry point to start understanding the complex sustainability landscape.

‘South Africa is one of the leading countries in terms of sustainability disclosure, particularly in the listed context,’ she says. ‘Our expectation is that the guidance will lead to even better disclosure practices and, consequently, to better investment information being made available, which in turn will enable investors to make better informed decisions.

‘Investors are increasingly interested in sustainability issues as this relates to all their investments, irrespective of whether they are large or small, equities or bonds, listed or unlisted, across all sectors. We believe that the characteristics of high-quality disclosure and effective engagement with investors is broadly the same for all entities, whether a large publicly listed issuer with a long track record of reporting, a smaller company, a privately held business, or a debt issuer. All these different entities are encouraged to use these guidelines.’

The voluntary document is aligned with the major frameworks, such as the Task Force on Climate-Related Financial Disclosure (TCFD), the UN Sustainable Development Goals, as well as the European Sustainability Reporting Standards and the prototypes of the International Sustainability Standards Board (ISSB, which is the new standard-setting body established by the International Financial Reporting Standards Foundation).

The South African Institute of Chartered Accountants welcomed the JSE guidance as ‘an important step towards obtaining a more consistent approach in the way listed entities should consider reporting their relevant sustainability information’.

Investor activist group Just Share praised it as ‘an impressive distillation of the recommendations of multiple global initiatives on sustainability and climate risk disclosure’ that will help ‘bring much-needed guidance for consistent, comparable, transparent and reliable disclosures’. Robyn Hugo, Just Share director of climate change engagement, outlines in an opinion piece that the JSE’s ‘double materiality’ approach is ‘far more useful’ than the TCFD and ISSB’s explicit focus on the risks and opportunities that affect a company’s financial performance.

Double materiality attempts to provide a full picture of a company’s impacts. On the one side, it refers to how a company creates value through its product or services, and how this impacts on society and the environment (‘inside out’). On the other side, it looks at how the environment or society impacts on the company and its products or services (‘outside in’).

‘Impacts on the environment and society cannot be de-prioritised on the basis that they are not financially material, or vice versa,’ according to the Global Reporting Initiative. ‘Moreover, a company should start with the assessment of the outward impact component of the double-materiality principle followed by the identification of the subset of information that is financially material to the company and their stakeholders.’

Over time, stakeholders are likely to fine-tune their own materiality lens. The JSE guidance recommends that the ‘inside-out’ information regarding the company’s impact on society and the environment should be made available in a manner that is consistent with the company’s reporting approach and target audience, and how it defines materiality, for example in a separate sustainability or ESG report in addition to the integrated report.

Companies should clearly state which reporting frameworks and standards they use for each report, in line with the intended purpose of that report.

‘What is material to a given organisation is dynamic and informed by the specific business model and operating context,’ says Jonathon Hanks, founding director of Incite, the sustainability consultancy that co-ordinated the drafting of the JSE guidance documents. ‘As the context changes, sustainability information deemed material from an impact perspective might become material from a financial perspective.

‘This could result from an internal shift in the organisation – for example, the company finds an innovative way to scale a social-investment initiative by linking it directly to the core business and profit formula – or it might be the result of an external shift, such as the introduction of a carbon or sugar tax that internalises a cost that had previously been passed on to society, and not directly impacting enterprise value.’

The guidance document gives detailed suggestions on what sustainability information companies should disclose and why this is important. In SA, the high level of unemployment, inequality and instability makes the ‘social’ metrics (relating to labour standards, human rights and community development, health and safety, customer responsibility and the supply chain) particularly important.

Labour disputes can, for instance, turn to unrest in a workforce and negatively affect the customer base, and, eventually stability in the country, according to Soobramoney. It becomes a material risk if it translates into ratings downgrades and increased cost of doing business for the company. ‘We need to ensure that certain social foundations are safeguarded,’ she says. ‘All these issues are very interconnected and require a systems view. That’s why having the full spectrum of ESG metrics is so important.’

To institute the required competencies among business leaders, the JSE has partnered with an initiative of King’s Good Governance Academy, called the ESG Exchange. This is a global collaboration with international standard-setters, regulators and professional bodies that intends to assist boards, corporate leaders and operational managers to meet the impending reporting requirements.

The three-year interactive programme, which launched in September 2022, consists of a ‘how-to’ playbook with five modules (data and technology operational processes; business analytics; auditors; report production; and repeatability and refinement). The aim is to make sustainability reporting less burdensome while establishing effective company-wide reporting proficiencies.

Yet disclosure and reporting alone will not automatically produce the desired sustainability outcomes. This only happens when companies embrace sustainability at all levels of their operations, making it part of their culture and DNA.

‘We need to move from incremental change to systems change,’ says Hanks. ‘Ultimately it is a question of rethinking our accounting system and how we measure success, moving away from short-term financial profit to provide instead for what really matters – our collective well-being.’

The JSE Sustainability Disclosure Guidance is a right step in this direction, but the pace of implementation has to pick up urgently for a better tomorrow.